Your Custom Text Here

The king is naked

The Diar has recently published some data on the treasury balances of ~100 crypto projects' ICO wallets, and I thought it would be interesting to run a few analyses on the data and see what sort of insights (if any) we can elicit. Before we dive in, it's useful to note that the projects examined here only represent 5-10% of the whole. There is a multitude of other projects that are not included in this dataset - or any other publicly available dataset as far as I know. If you happen to know of a more comprehensive resource, do get in touch. Now without further ado, let's get to it;

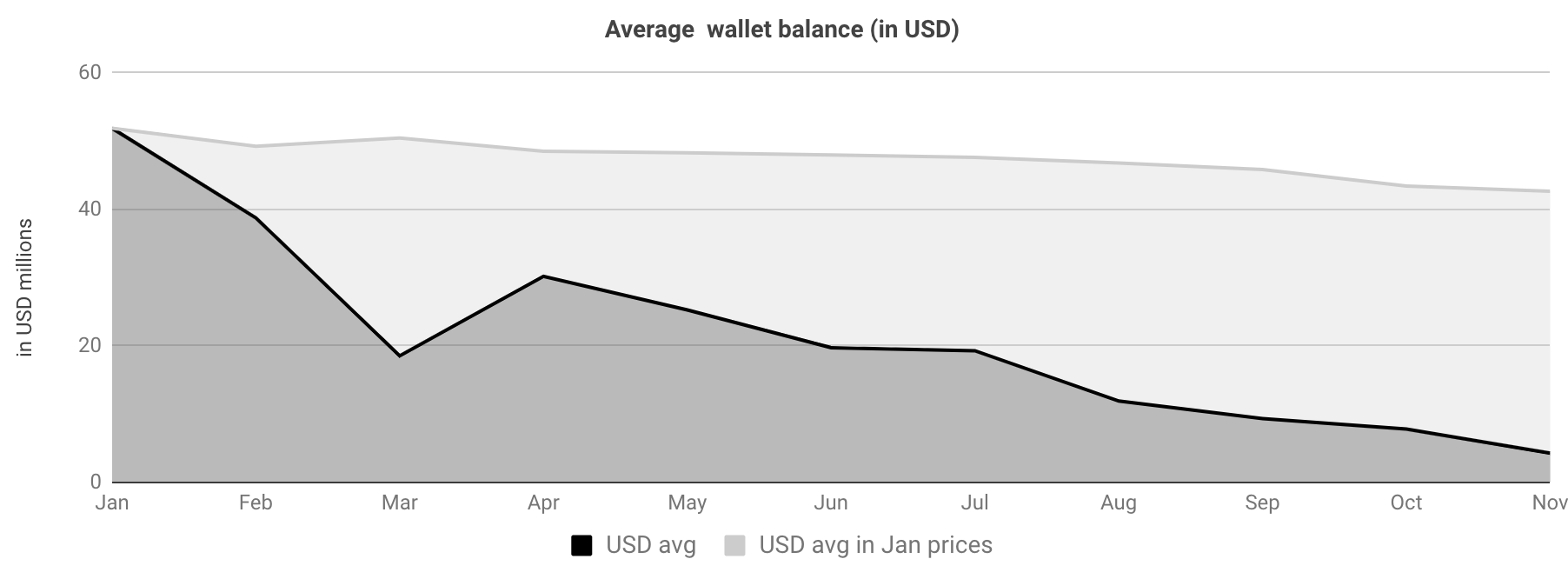

The first figure shows the total ETH balances in the projects' wallets and how that figure has been shaped over the course of the year. The total wallet balance has decreased by 17.8%, while ETH's price has decreased by ~90% from January 2018. Putting two and two together, this amounts to a 92% decrease in the USD value of those holdings. In absolute terms, the average project's treasury, lost about $38M in potential value held, since January - see figure below.

Theis is a summary of the simple average size of a random project's treasury, accross 2018, expressed in USD terms. The dark area represents the actual value of the treasury, while the light shaded area, represents the value lost due to ETH's price depreciation. In order to highlight the degree of potential mismanagement, let's run a quick thought experiment; starting out in January 2018, project ABC has $55M in its treasury. Let's also assume that the optimal budget distribution for ABC, looks something like what's presented below.

The above implies that ABC can hire approximately 60 professionals (engineers, ops, marketing), at Silicon Valley salaries (~$180k a year average), and keep them employed for 3 years. While I don't have concrete numbers on this, last time I checked, most projects that raised in 2017 are not on a hiring spree of that magnitude. Let's further assume that ABC actually consumed 17.8% of the $55M they raised (approx. $10M), out of which $5M is committed towards payroll (by the above assumptions). With that they hired 9 people, which sounds about right. Now, had they managed their finances optimally, they would still have enough money to hire another 50 people to help them build and ship. What the reality points to is that they can actually hire about 3 more people at SV salaries and keep them employed for 3 years. That's a tentative loss of 47 high quality professionals. Wow! Surely there was no CFO among those 9 hires that ABC went ahead with in 2018...Note that we are talking about are technology organizations that have raised money to deliver a product/network - not finance shops. As such I don't see how they can justify being long ETH.

Now let's have a quick look at how the total ETH liquidation activity relates to the price of ETH.

The correlations here are not very revealing; there is a positive 30% correlation (relatively weak) between this month's ETH liquidation and next month's %D in the price of ETH and a negative 40% correlation between this month's ETH liquidation and this month's %D in the price of ETH . In other words, there is some correlation between projects selling ETH and the price of ETH dropping, but it seems to not be the most compelling reason why. Again, we are only tracking ~5% of all projects here, so there is a chance that the correlations would increase if we had a more complete picture.

To round off the analysis, let's take a look at how specific projects have managed their treasuries thus far.

The dark area signifies how much the project's treasury was worth in USD terms in January, while the the light area represents the % of the treasury that the project consumed (or liquidated to USD). There are a few key observations here; (i) the distribution between total value in January and amount consumed is random, (ii) the amount consumed has not impacted price overall (for most projects) - one would assume that better management would translate to the market pricing that in and (iii) some of the most hyped projects, like Tezos and Golem, have consumed none of their ETH holdings in 2018.

There are a few conclusions that really stand out here; (i) the average project has no idea how to or low interest in managing their treasury and part of that lack of activity is most likely owing to the fact that (ii) in 2017 projects raised way too much money, compared to what they needed to ship product. It would also appear that (iii) many of the teams succumbed to the whims of an anchoring bias, and while the USD value of their ETH holdings 2-5xed over the course of 2017, they didn't bother to liquidate some, as that was way over the amount that they initially asked for. Of course, this is something that we already knew, but interesting to see how it has played out over time. This abundance of (notional) capital, surely did not create an optimal incentive structure for the teams.

As the industry matures, the need for diverse skillsets is evident, as is the current lack of design and ops/finance people in crypto - despite the increasing flow. While there are many things wrong with the "real world" that crypto has the potential to improve, there are equally many things done right, that crypto would be better off adopting.