Your Custom Text Here

Liquid Staking != Liquifying Stakes

My presentation on Liquid Staking from the GCC x Ethereum Foundation meetup, in May 2021.

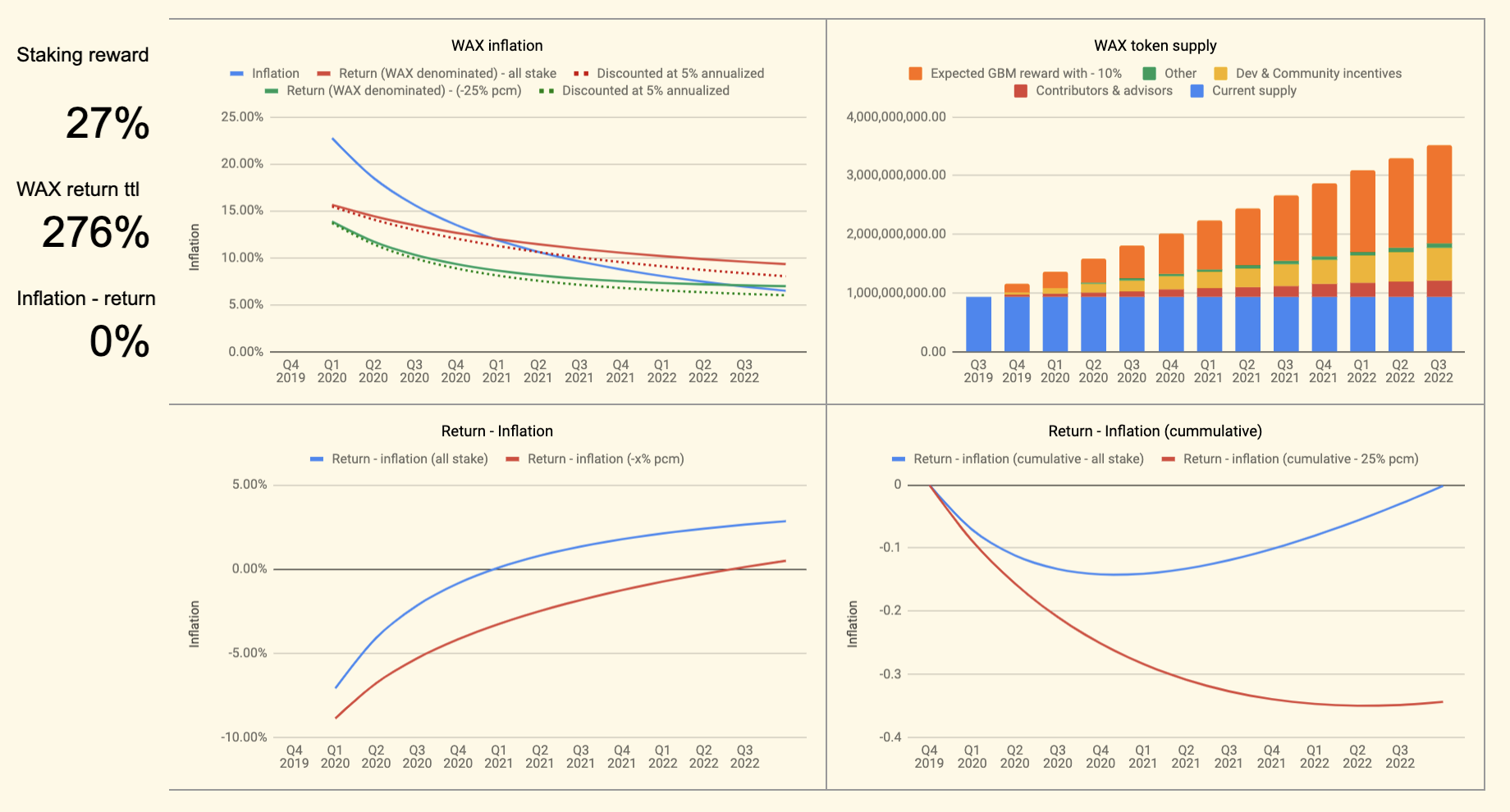

Modelling out the WAX mainnet token economy offering

The present report has been put together drawing from two editions of Decentral Park’s internal daily newsletter, and is presented in format similar to the original (Part 1 & 2). The key findings here are:

WAX will double its notional total supply upon mainnet launch. This is a notional 50% dilution of current holders.

Current holders will have the opportunity to maintain their pro-rata share, only if they remain staked for 3-years - they will receive 1/1092 of their total staked holding every day for those 3 years. Should Genesis Block program (GBM) participants unstake at any point, they lose claim to the remaining residual value stream, and that stream is burned.

Given that the available staking return outside the GBM is roughly 1%, one should consider committing for the whole 3 years of staking, IF and only IF they expect the demand for WAX to increase in excess of the supply of WAX tokens by ~ $130M, over the course of 3 years.

WAX currently owns a large proportion of the total supply. Given that their incentives to remain staked (e.g. lower opportunity cost) are higher than most other parties, they are highly likely to end up with a higher pro-rata share of the network/tokens, at the end of 3-years.

Further, they will initially run 20/21 Block Producers, earning the majority of the inflationary rewards - until they hand over to other interested parties. That further puts WAX in an advantageous position over their token holders - except for if they waive all rewards that accrue from producing blocks.

Please remember that while the model that powered this report is not perfect (e.g. doesn’t make a clear distinction between circulating and non-circulating supply - and probably misses a few more nuances), it is very useful in uncovering different scenaria, and setting benchmarks with respect to the value of the WAX token in the next 3-4 years.

What we know:

- current available supply: 942,732,360 WAX

- total supply: 1,850,000,000 WAX

- total supply will be raised to 3,700,000 WAX by 2022 - a 2x increase

- the additional total supply will be distributed as Genesis Block Rewards (GBM)- a drip function that doubles your holdings in WAX in 3 years (you receive 1/1092 every day), so long as you keep your holdings staked.

- the staking rewards outside that, are speculated to be 1% annualized

If you read between the lines, what WAX is saying is that they will be diluting everybody by 50% over three years, unless they commit to staking all their holdings - and still be subject to some dilution via inflation.

Let's see what modelling with these parameters looks like;

So, should one keep their WAX bonded for 3 years, they should receive 105% their initial WAX back. However, when accounting for inflation, the effective return is -66%, assuming that no new demand hits WAX post Mainnet (edge case).

The curve becomes much steeper when assuming that the staker unbonds 20% of their holdings every month (green line). In other words, the system is designed to keep you locked-in for the whole 3 years.

In order to "break even" under these conditions, one would need a 27% staking yield (annualized) - which is categorically out of the question.

Indicatively, in order to keep the token price at current levels, given the amount of inflation currently planned, WAX would have to 4x its marketcap over three years.

That is add another $180M to its marketcap (1% of the current crypto mcap). However, given that the digital items trading space is projected to be worth somewhere between $20B and $50B, this is not unlikely.

What else we know:

- if you don't participate in GBM upon mainnet launch, you don't get to participate in it ever (happens automatically as you send ERC-20's to burn address).

- as you unstake from the GBM allocation, you cannot re-stake and the remainder of that allocation that would be earmarked for issuance is burned.

What this means is that if we don't see demand for the platform front-run the Mainnet launch to secure allocations for access to the WAX blockchain (which should lead to a nice price bump), every unit of demand that comes to WAX post-Mainnet launch, effectively decreases the inflation rate - as stakers that don't need real estate on WAX (e.g. exchanges or WAX itself), pass their Mainnet tokens on to the incoming demand. As these tokens are unbonded, the earmarked future issuance is burned.

Now, with that in mind, let's have a look at how this plays out, when incorporating these parameters into the model - initially assuming a 10% growth in demand for WAX tokens (as a proxy from demand for real estate on the WAX Mainnet) per quarter.

The growth in all examples that follow, is benchmarked off of $1M initial (new) demand for WAX tokens, starting from Q4 2019.

It seems that with a 10% demand growth, the net improvement is only 4%. Not ideal.

Let's see what happens when you increase the growth projection to 30% per quarter.

Much improved, however, when adjusted for inflation the net return is still negative.

With a little more experimenting, we get to a break-even growth figure of 38.2% per quarter. That translates to approximately $130M of fresh monies hitting the WAX token economy over the course of 3-years.

Beyond that point, things get really interesting. The output for 45% growth per quarter (or ~$200M over the 3 years) points to a 61% inflation adjusted return for the staker. I've also included a positive projection, with the assumption that $2M of new demand hits WAX post Mainnet, with that demand figure growing at 30% per quarter.

The inversion of the "Expected GBM reward" schedule when accounting for demand, should lead to material price appreciation.

Concluding remarks

If the output of the model is correct, then one should consider committing for the whole 3 years of staking, IF and only IF they expect the demand for WAX to increase by ~ $130M over the course of 3 years. Again, considering that the digital items industry is worth $20B to $50B, this is not unlikely at all.

If on the other hand, that kind of confidence in WAX's future performance is not there, then the numbers point to the fact that the potential staker should pack up for greener pastures.

As it stands the holding base of WAX is highly centralized, and so if the thesis about demand seeping through to the platform post Mainnet launch is correct, then things should play out somewhere in the range outlined above.

Part 2

When Part 1 was drafted, the 1% staking reward was taken as anecdotal speculation. Part 2 revisits some of the elements explored in Part 1, accounting for additional information shared by WAX - among which, confirmation that the staking return is likely to range between 0.5% and 1%. Why? Well because staking returns are distributed among stakers (roughly) as follows:

staking return = (tokens staked/total tokens staked) * voting engagement scoreThe voting engagement score ranges between 0 and 1 and to be as close to 1 as possible, you have to be engaged in voting for guilds (delegates) on a weekly basis. As outlined in Part 1, the 1% return is not nearly enough to provide a potential staker with satisfactory enough incentives to stick with it for the long-run. With that variable now known, what the model implies is, in fact, that for the staker to break even, the new demand for WAX token, in excess of current equilibrium, would have to start at approx. $1.15M in Q4 of 2019 and grow at ~40% every quarter from that point onwards.

All things considered though, simple staking is not the only way to earn rewards. If the holder believes that the excess demand condition outlined above and in Part 1is likely to transpire, it would make sense to increase their engagement by either running a Guild (Block Producer), OR at least funding one, so that they ultimately increase the magnitude of the residual return we might be entitled to.

The team recently announced that Hyperchain Capital will be running 1/21 Guilds. The remaining 20 will be run by WAX and a company called StrongBlock.

I find that somewhat concerning. Part 1 concluded that WAX currently owns a large part of the already existing supply of WAX tokens. With them being the residual claimants of the vast majority of the inflationary rewards (at least for the launch and post-genesis periods) only compounds the effect and net-net attributes to WAX being diluted less than all other holders, effectively increasing their share of the token economy.

What is also outstanding in the above statement, is that it implies that the time when WAX decides to relinquish control, is 100% their call (as we gradually roll out), and potentially still a work in progress.

Further, another inconsistency found, was that while WAX quotes the annual inflation figure to be 5%, given that the total supply will double in 3 years after Mainnet launch, the effective inflation rate starts closer to 25%. If this is a perpetuity of 5% added on top of that initial 25%, then the dilution the passive investor would be facing, would be even steeper[1].

Even with the new batch of information on the table, it appears that there is still more pending. More particularly WAX has hinted to "transfer agents" and the "WAX Marketplace" as other ways to earn WAX tokens, more on which will be released in the coming weeks. Within the latest comms from the team, there is also a mention of an additional way to earn WAX tokens at Mainnet launch.

Concluding remarks

If this was the private market, WAX’s strategy would make sense - dilute your earlier investors and ask them to top up on their investment to maintain their percentage of ownership (for those that don’t have any pro-rata clauses at least). In the private markets however, when the time to raise the next round would come (the Genesis Block Program looks very much like a next round for WAX), the valuation of the company would stand at ~2x to 3x the previous rounds. On the contrary, WAX’s current valuation stands at ~1x that of the previous rounds, while token holders have already been diluted by approximately 40%. Consider the following:

June 22nd, 2018:

WAX Mcap: $72M

Token price: $0.113

May 26th, 2019:

WAX Mcap: $72M

Token price: $0.077

That’s a 40% hit on the token price, caused by the new WAX tokens entering circulation. Given all of the above, there is little to point towards the trend reversing here, and the market seems to have caught wind of that. Since the WAX team started drip feeding information about the upcoming Mainnet release, the token price seems to not have responded favourably (yet). One would expect demand to materialize, as investors would rush to secure their Genesis Block Program spots - alas, to no avail, amounting to an affirmation of the concerns raised throughout Parts 1 & 2 of the report.