We are observing an interesting trend as of late; prices drop, producing disincentives for miners and validators to participate in securing the networks and as such, the level of decentralization diminishes, ultimately leading to the probability of the network being compromised increasing significantly, as the cost of mounting a 51% attack drastically reduces. This year, some of the most prominent cases have been Bitcoin Gold, Monacoin and Verge. All it takes is funds to rent enough hashing power to control 51% of the network and some technical knowledge to mount the attack. Let's take a quick look at what that implies for the industry overall;

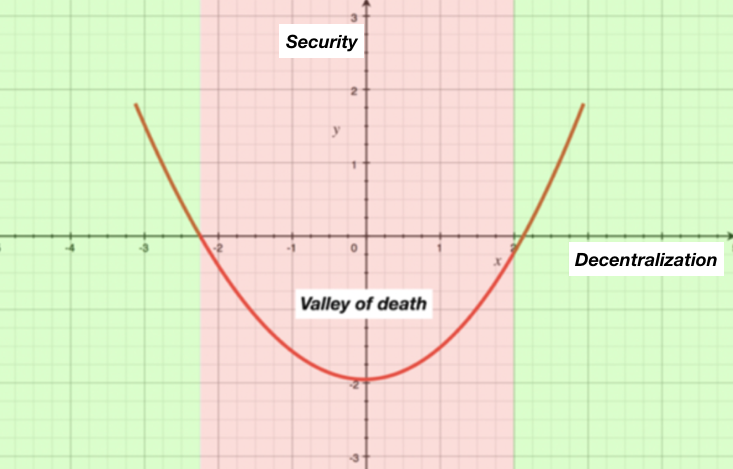

Blockchain networks that will survive ought to be either sufficiently decentralized with wide participation or outright centralized. Otherwise they're stuck in the middle and bound to eventually wither away. On the left hand side of the plane we might see applications in federated, low trust environments (e.g. inter-bank clearing systems), while on the right hand side applications will tend to low trust environments with wide participation of parties (e.g. super-sovereign money or DAOs). I am increasingly of the mind that whatever is in the red, should not exist. Let's now have a look at what happens with trust on the y axis.

The problem with centralized networks is that except for if they are represented by a trusted institution (like the US government?!), the amount of trust that goes into it diminishes sharply (think Facebook, LIBOR etc). Of course, we have to consider that the majority of users of various services the world over, are willing to sacrifice some trust and security for performance and convenience. However, we should also consider that before the Bitcoin blockchain, the option of high trust and security was not available. Excited to see what kind of applications the future brings on the right hand side of the plane!