Your Custom Text Here

Bitcoin bubbles; the optimal distribution mechanism

Why planned fair distributions don't work for broad use cases - adapted from an internal memo drafted in May 2019.

Bitcoin’s volatility profile is - by now - the stuff of legends. Monumental, euphoric rallies give way to abrupt, violent crashes and proclamations of Bitcoin’s demise (380 and counting). Thus far, the cycle has repeated without failure, earning Bitcoin the “Honey Badger” moniker in the process.

As the current cycle is unfolding, behind the BTC/USD pair’s most recent gyrations, new types of participants are entering the market; traditional macro money managers (e.g. PTJ) and nation states (e.g. Iran) are becoming increasingly open about dipping their toes in the cryptoasset ecosystem.

With every new type of player that jumps on board, the likelihood of Bitcoin becoming a widely accepted store of value and the Bitcoin blockchain becoming a globally accepted settlement layer, increases. The “why” Bitcoin makes for a good settlement layer and store of value has been covered extensively. However, the “how we get there” remains somewhat elusive. In this post, I will attempt to unpack that.

Fair != Equal

Let's for a moment imagine what an optimal state of the Bitcoin network at maturity looks like; Bitcoin is a widely accepted global store of value and/or settlement layer; global institutions (e.g. central banks) are on board, co-existing with crypto-native actors (e.g. miners); market manipulation is too expensive to attempt, as are direct attacks on the network; BTC is distributed widely among holders, such that network participants extract maximum value by being able to settle with all other parties they may wish to, and that no party has disproportionate “bargaining power” over network outcomes, allowing participants in the network to be continuously incentivized to remain participants.

From the above, a “fair” allocation of BTC among holders seems to be a key underlying requirement for this future to come to bear. Note that “fair” is not the same as “equal”.

Fairness, in this case, implies that every participant’s utility function is maximized, subject to their unique constraints. Under that condition, “equal” is “unfair” and therefore, unsustainable.

If we assume the “fairness” condition as requisite, then while not necessarily an easy pill to swallow, the rollercoaster ride might be the *only* path available to get us there. To illustrate the point, an approach by deduction reveals why the competing approaches cannot work;

A centrally planned diffusion mechanism: this construct fails as the planner holds all the bargaining power - such that no other party would willingly opt-in. In order to be executed effectively, it would have to be orchestrated and delivered by a benevolent dictator (a party with perfect information and perfectly benign incentives), and for all participants in the network to trust that the allocator is indeed benevolent. In practice, impossible.

A diffusion mechanism planned by a “political” coalition: this can’t be orchestrated in a multi-party explicit negotiation format, because there are too many conflicting interests at play in order to implement top down consensus. If it is sufficiently hard to achieve with structures where there is some cultural cohesion (e.g. EU and the Eurozone), it should be near impossible to achieve at a global scale.

Economic bubbles as a by-product of fairness

So if we agree that neither of the two are viable options, the only option left is a free market mechanism; a continuous game, that is played by individualistic agents with hidden preferences, in near infinite (and infinitesimal) rounds, that allows for each participant to opt-in at the valuation that perfectly satisfies their objective function (what they strive to maximize under given constraints), therefore covering the full utility spectrum of the population of agents.

Hidden preferences become revealed ex-post and as such competing agents cannot devise a strategy that creates a surplus for themselves that leaves others at a deficit ex-ante, resulting to an ultimately fair distribution. And in the process of revealing preferences in a continuous game with infinite rounds, bubbles are created. Competing agents with similar objective functions are forced to respond to the first mover among their counterparts and jump on the bandwagon. Under scarcity, the price rallies, until the reservation price of agents that opted-in earlier is met. At that point the distribution phase begins, as earlier participants divest and get rewarded for stewarding the network thus far, by locking in a margin. As painful as the process might be, it ultimately yields to a fairer allocation.

As the "rounds" of the tacit negotiation - come free-market-bonanza - game unravel, the very nature of the platform evolves, opening up to a wider possible utility spectrum. With time, the network becomes more secure as wider margins become available for miners (either through higher prices or through advances in operational efficiency) and more resources are committed towards Bitcoin’s Proof of Work. It follows that as the network’s security improves, it opens up to new types of agents that are striving to maximize value preservation potential, subject to the liability they have to their constituents (measured as risk). The more types of agents there are on the network, the better a settlement layer it becomes, and so on.

Therefore, there is sense to the idea that progressively larger agents would opt-in at a higher prices, as they are effectively buying into a fundamentally different - and arguably better - network for value store and transfer. And with every new type of agent unlocked, the bandwagon effect re-emerges.

Conclusion

Bitcoin might not have been a secure or wide enough network for Square (an agent to its shareholders) to consider as its future payment rails and settlement layer in 2015. It is in 2020. Similarly, while Bitcoin might not be a secure or wide enough network for a sovereign to opt-in in 2020, it might be in 2025.

So, not only should we not be surprised by the new type of participant that is emerging in the early innings of this cycle, but we should expect more of this as the network’s value increases and its security profile improves.

And in the process, we should learn to accept the nature of the game.

Cryptoassets in transition

Taken from Decentral Park’s Annual Investor Letter for 2019

2019 has been quite a ride for global markets. The year started with a rallying S&P and confident markets which quickly transitioned into fear, uncertainty and doubt, as the Sino-American trade war took center stage and the yield curve inverted for the first time since 2008, summoning fears of an impending recession. In that environment, cryptoassets had a mercurial H1 2019, coming off of a brutal bear market in 2018.

Emerging cryptoassets within the cluster outperformed the average in Q1, passing the baton to Bitcoin in Q2, which led the way with a 230% appreciation, bottom-to-top, from April to July 2019. At the time, there were strong indications that the pent up demand for capital flight from China found a suitable vehicle in Bitcoin, as global economic uncertainty rose [1]. However, this did not sustain for long, leading the overall asset class to deflate by ~50% over the course of H2 2019.

Although Bitcoin failed to meet expectations set by the excitement garnered by 1H19’s run-up to $13k per BTC, the asset class overall is once again the best performing for the year, returning +90% beginning to end, whereas the NASDAQ returned +38%, the S&P +31% and REITs +27%.

Be that as it may, the sentiment among market participants - at present - is much bleaker than the absolute YoY performance implies, reminding us that biases are omnipresent in how sentiment manifests in markets. In this case, it is an anchoring bias, a recency bias and loss aversion in full effect [2].

As Bitcoin descended from July highs for most of 2H19, the trade war fears were dispelled and under the onlook of a dovish Fed, the Dow and the S&P both broke to new all-time highs. Considering the developments within the world of cryptoassets, we are - quite frankly - dumbfounded by the weak sentiment. While being cognizant and appreciative of the limitations of cryptoassets and the challenges that lie ahead, we cannot help but continue to be optimistic about the medium and long term prospects of the asset class.

2019: a year of quiet infrastructure development

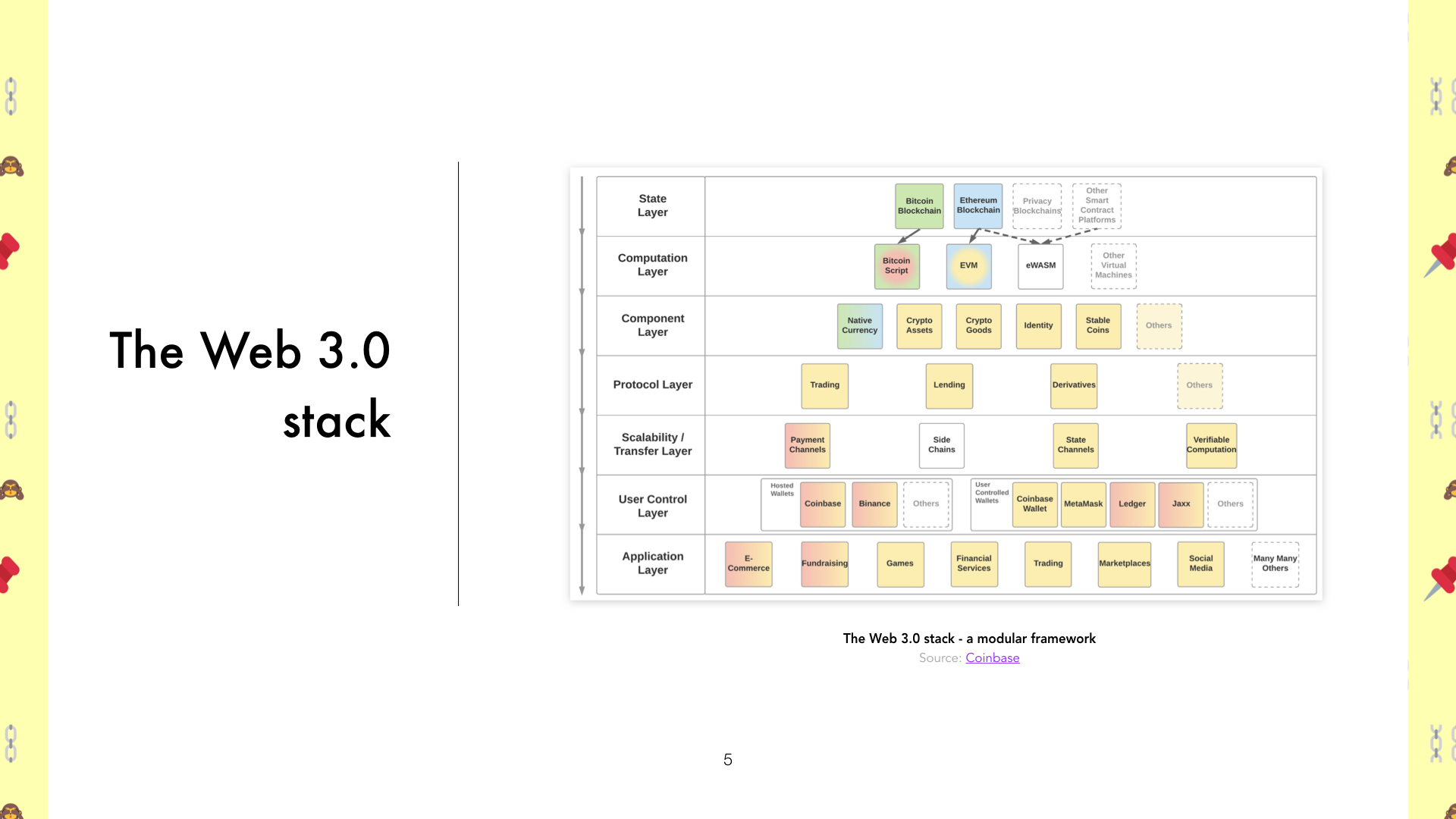

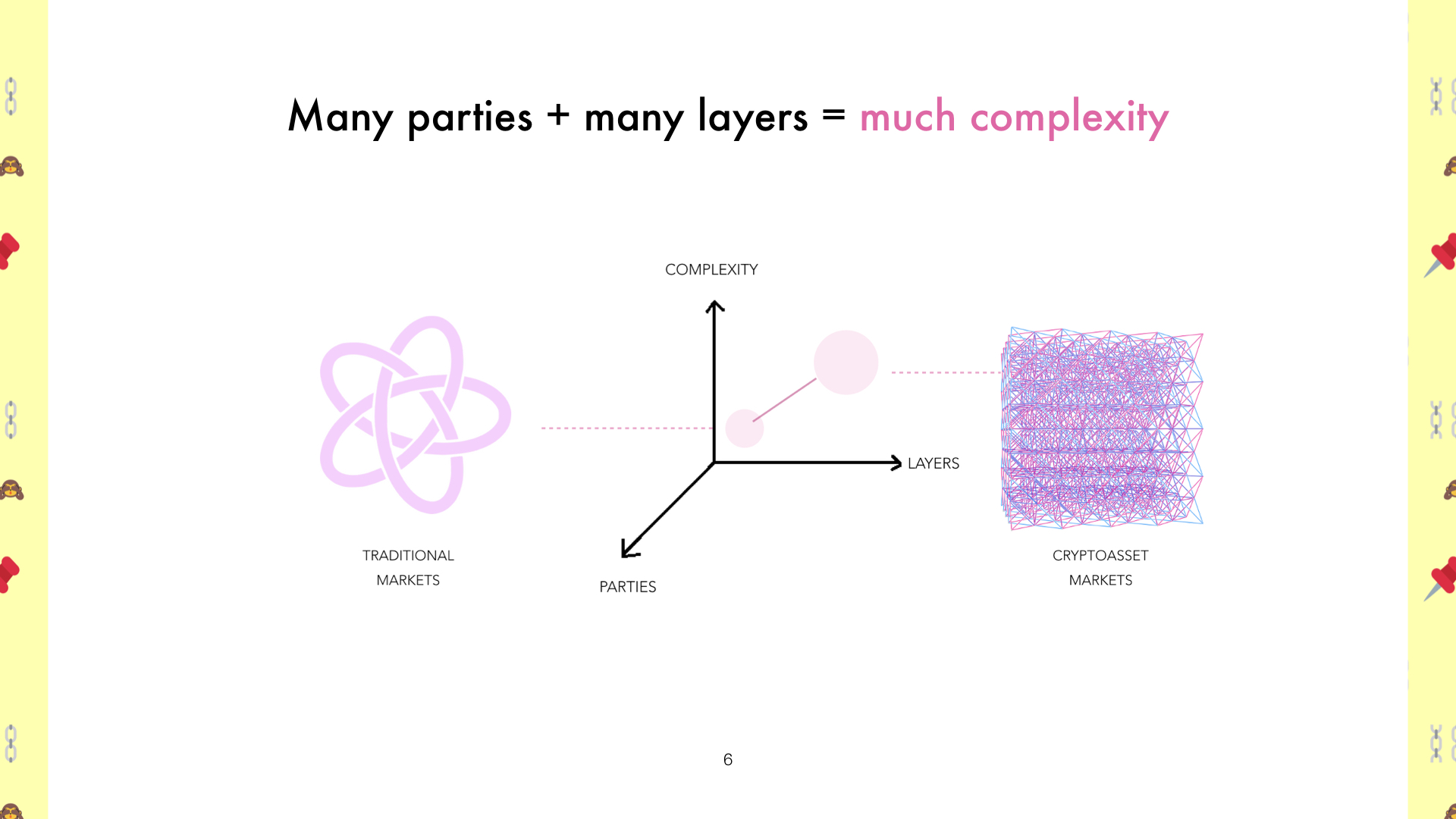

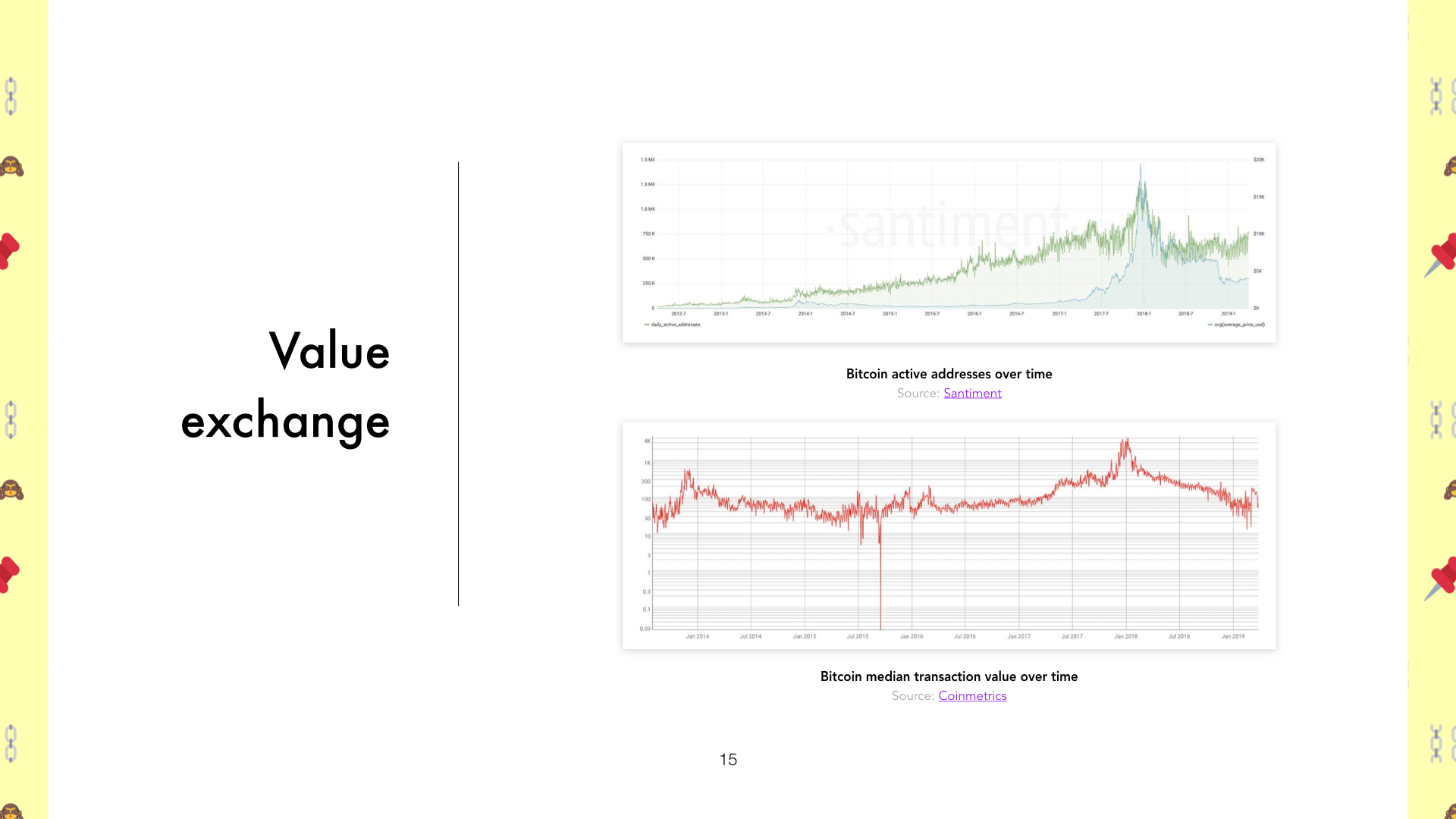

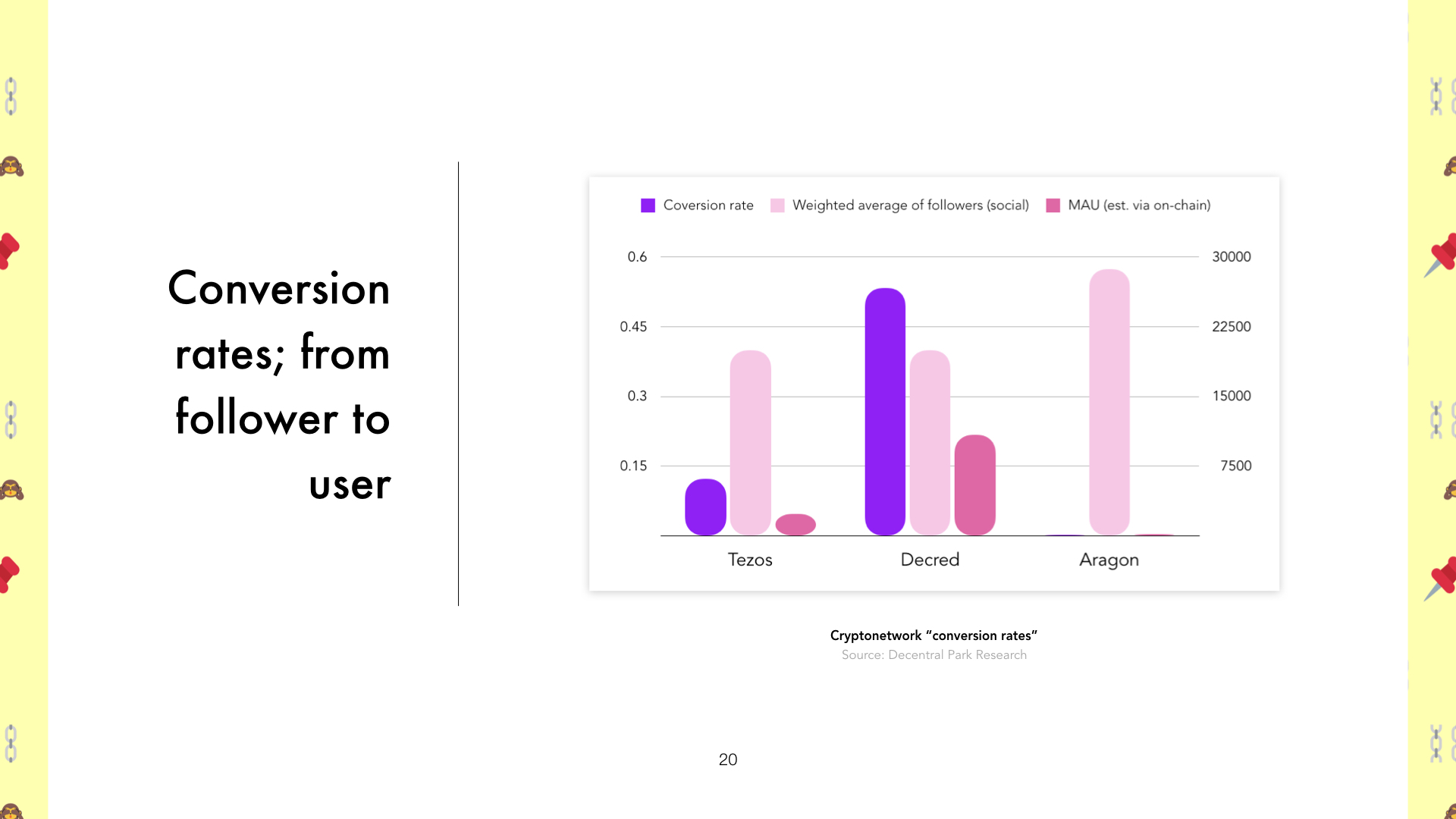

Our thesis has always been that there are two forces that charge adoption prospects for cryptoassets; 1. top-down adoption by institutions and legacy finance, and 2. bottom-up adoption of Web 3.0 and Open Finance innovations and primitives by the general public. 2019 was a year of steady infrastructure development and deployment in both of these areas.

Top down

2019 saw a continuous stream of innovation in institutional infrastructure, with cornerstone products such as digital asset custody and derivatives being delivered and further developed from both legacy players such as Fidelity, ICE and the CME [3], as well as crypto native players such as Coinbase, BitGo and Binance [4]. These advances are bringing mature and trusted prime brokerage solutions closer to the cryptocurrency industry, and will enable the deployment of ever more complex strategies at scale, while simplifying the complexity at the base layer of this technology, head-on.

At the same time though, 2019 saw multiple rejections of applications for a Bitcoin ETF - and for good reason. The market is still fairly fragmented, small and immature for an ETF, with a prime example being the lack of a generally accepted and agreed upon true price of Bitcoin. Despite this, in December 2019 Charles Schwab reported that Grayscale’s Bitcoin Trust is the 4th most popular equity amongst Millenials in their customer base - more popular than Netflix or Berkshire Hathaway [5].

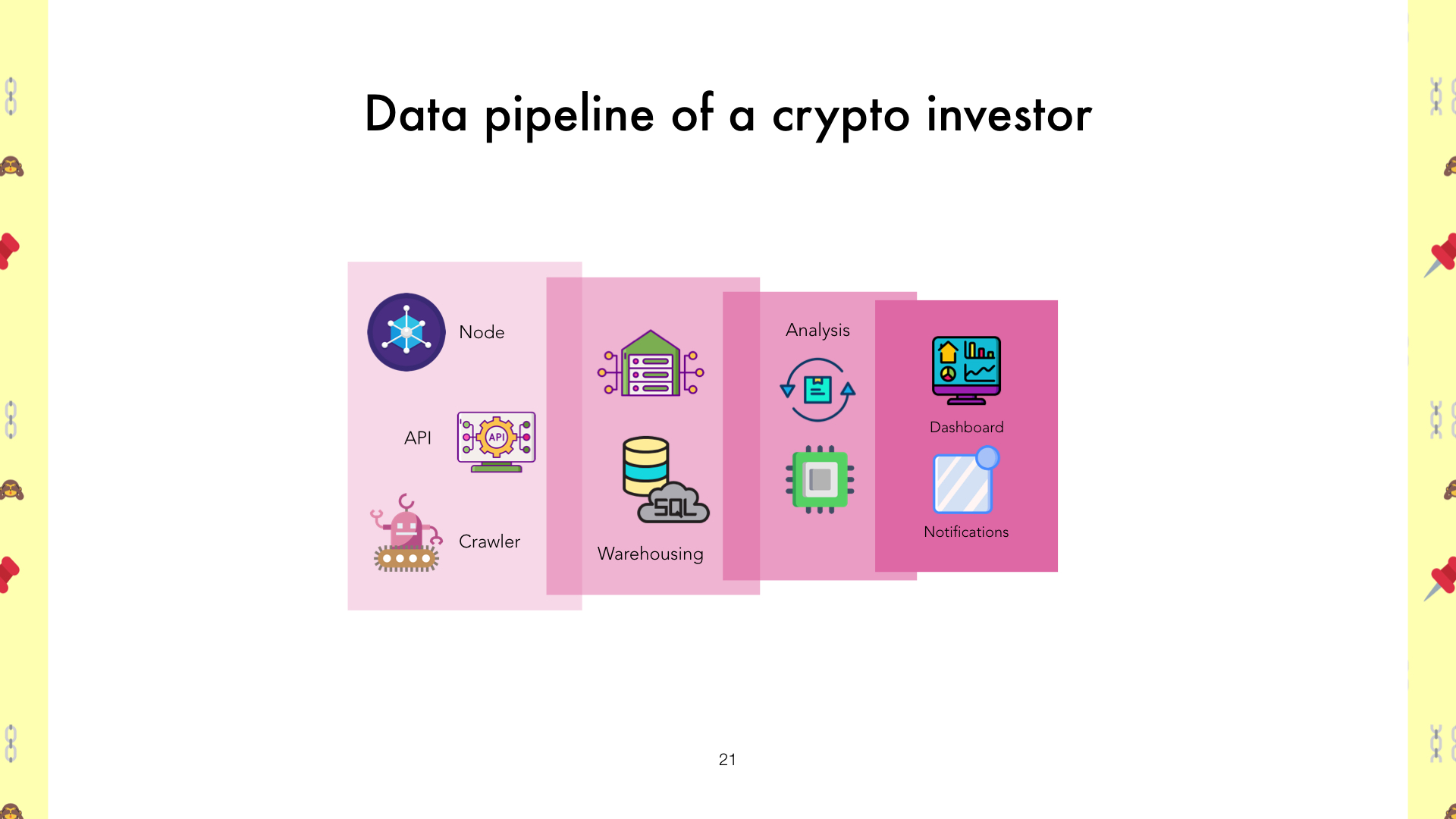

As progress in data pipelines is made and liquidity improves, the uncertainties around the asset class will become increasingly less, at which point we expect to see the development of products that will make Bitcoin’s inclusion into ISAs (Individual Savings Account) and IRAs (Individual Retirement Account), a matter of routine.

While we do not believe that this will become commonplace in 2020, we do believe we will see material progress in that direction, both in regulations, and in market structure/infrastructure.

Once that milestone is cleared, and the asset class has grown sufficiently to become even more generally accepted, the probability of it being included as an asset of pension funds and endowments increases dramatically. The most forward thinking of the largest allocators are already getting smart in and around the asset class, primarily via allocating to Venture Capital [7], while some have started dipping their toes in direct token purchases.

The last but perhaps most important piece of the puzzle for top down adoption is regulatory clarity - or, at present, lack thereof. Bitcoin’s Q2 ascent was accompanied by the announcement of Libra - Facebook’s blockchain-based stablecoin initiative, that would - upon launch - bring digital wallet infrastructure to Facebook’s massive user base.

Libra’s launch was soon put on hold by US lawmakers, with both Mark Zuckerberg and David Marcus (Libra CEO) having to undergo multiple rounds of hearings in front of the US Congress and Senate. The biggest result to so far come out of those hearings, was the lack of alignment among members of the House and Senate, which continues the uncertainty for entrepreneurs and managers in the space.

Meanwhile, in October, Xi Jinping publicly labeled blockchain an important strategic focus for China, causing a flurry of activity in the market [9]. Amongst the most notable events to follow, the Bundestag issued a decree enabling German banks to sell and custody crypto starting 2020, the ECB announcing a proof-of-concept for anonymous transactions using central bank backed digital currency, and more recently a draft bill entitled “Crypto-Currency Act of 2020” was introduced in the US House of Representatives.

Given the sense of urgency that China’s aggressive move seems to have instilled in its counterparts, we believe that 2020 is going to be a pivotal year for a much needed regulatory framework that will de-risk the emerging asset class.

Bottom-up

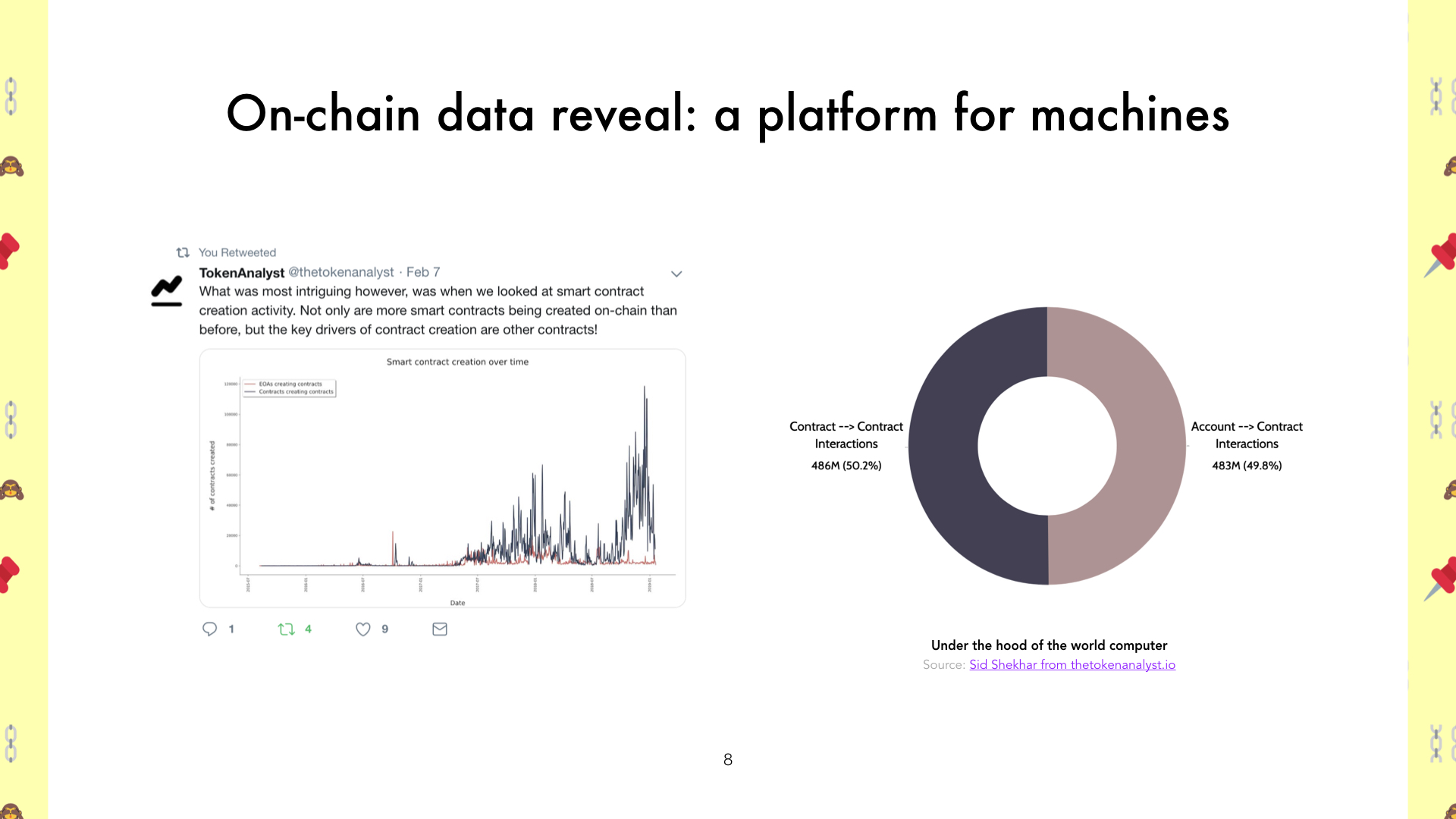

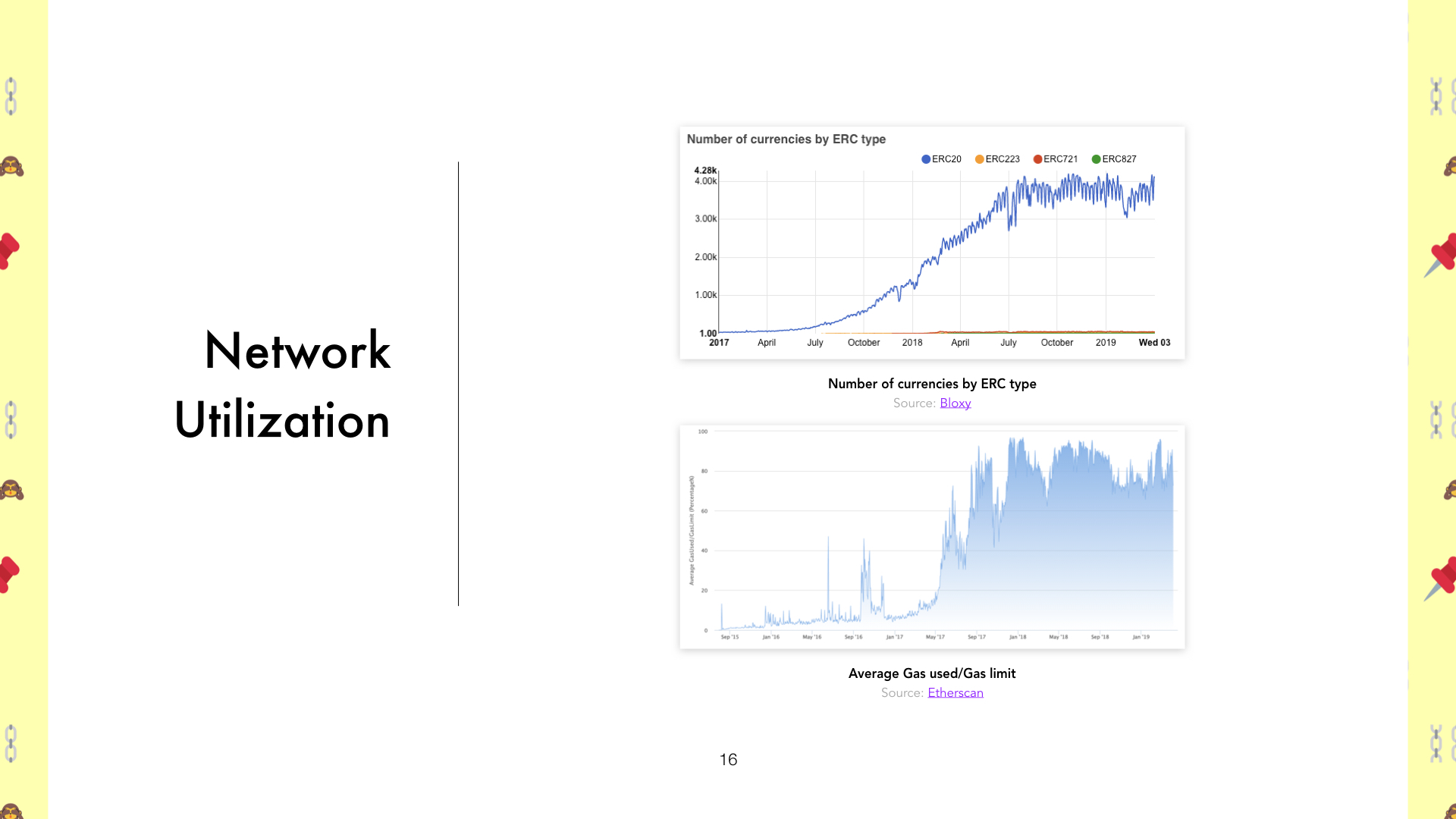

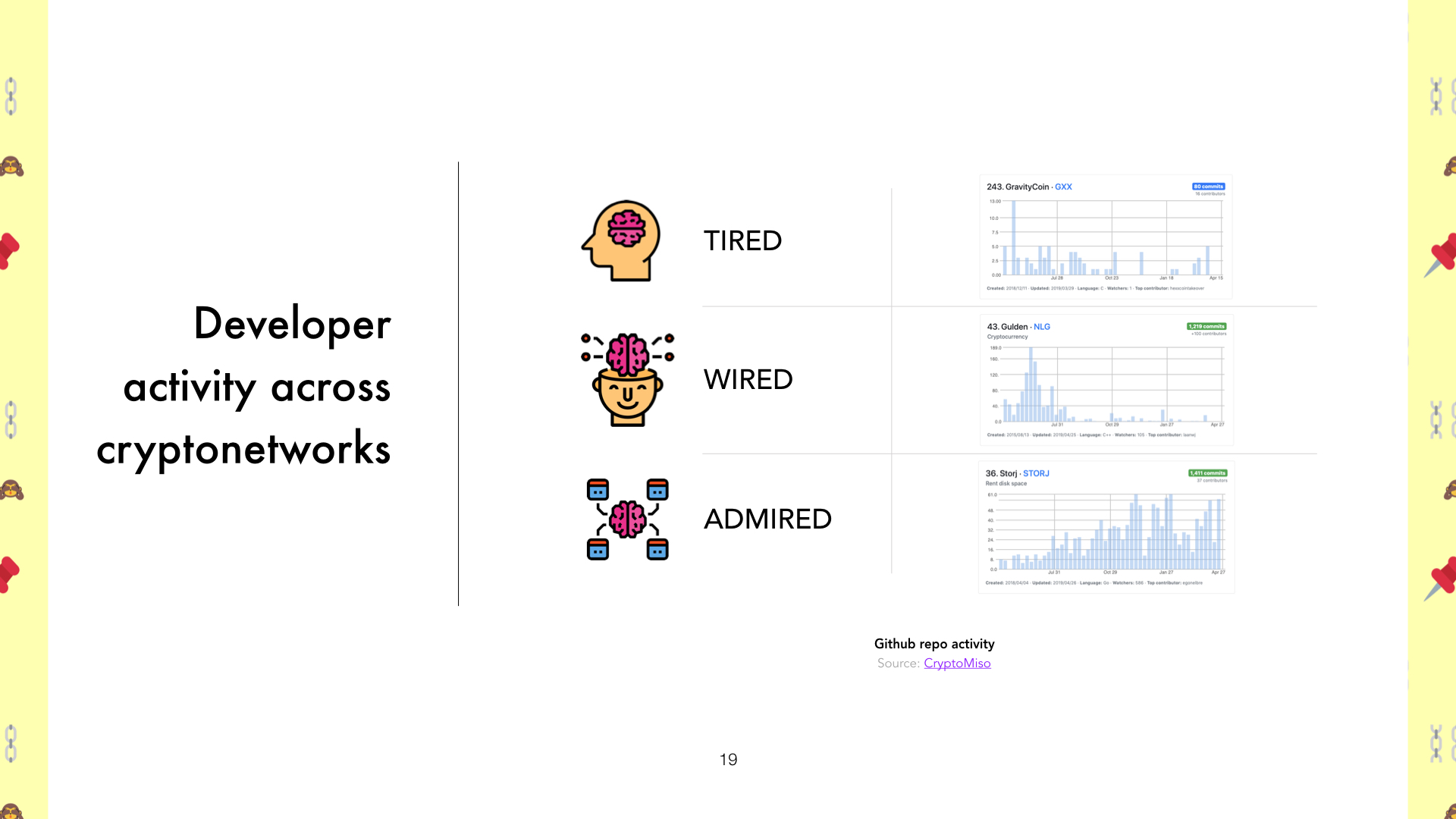

Even in the face of structural uncertainty, in 2019 the builders have been hard at work and their labour is already bearing fruit - with Ethereum (#2 public blockchain and #1 smart contract platform by market capitalization) the clear leader in attracting developer interest. Ethereum has been a hotbed for developer activity, with Open Finance (or DeFi) use cases finding notable traction.

There are now stable value issuers (e.g. Maker DAO), loan facilities (e.g. Compound), market makers and exchanges (e.g. Uniswap, Kyber) and derivatives facilities (e.g. Synthetix) that are fairly well established, while we are seeing use cases in insurance (e.g. Nexus Mutual), interfaces (e.g. Zerion), and payments (e.g. xDai) emerge.

These protocols and applications live purely on-chain, are largely software operated and have processed multiple hundreds of millions of USD in loans, payments and collateral value in 2019 [10].

Over the course of 2019, Ethereum became a lot more expressive. There are now more frameworks, IDEs and mature blocks of value within Ethereum that can be used as references for new applications, enabling developers to deploy a wider array of features, faster than ever before.

Given the product/market fit that the category is showing, Ethereum’s lead in developer mindshare and maturity of tooling, but also being cognizant of the platform’s scaling and governance limitations , we believe this to be the space where most value will be created and captured in the next 2-3 years.

It is indicative that in an indexing exercise exploring 2019 returns, DeFi has been the standout performer, primarily driven by the mercurial H2 performance of Synthetix (SNX) - a 30x run. Additionally, the money and finance related indices have strongly outperformed all other clusters in 2019 - a clear indication of where product/market fit can be found at present and how much it matters to the market.

Some of the areas that we are excited by within the cluster, are synthetic asset solutions that will reduce collateral ratio requirements, allow for legacy assets (e.g. equities) to be printed on chain and transacted at a fraction of the cost of traditional brokerages, enable new forms of hedging risk for crypto native businesses (e.g. hashrate derivatives) and - well - new forms of leverage. After all, given the early stage we are currently in, speculation largely remains the main use case.

Concurrently, in 2019 we saw glimpses of the rise of domain specific chains. Different fee structures for platform resources and performance limitations and trade-offs across different chains create breeding grounds for fundamentally different applications. As such, while Ethereum has found traction in use cases that are described by low friction and high transaction value, chains like EOS - and more recently WAX - are finding traction in high friction and low volume applications (e.g. games) [11].

While - in theory - Layer 2 solutions can allow for such applications to work on slower chains, it is hard to argue that these solutions will provide a more compelling alternative to chains that are purpose built to withstand heavier loads.

However, most of the aforementioned platforms are still in their infancy (e.g. WAX) and others are yet to launch (e.g. Telegram’s TON), as is the case with the interoperability bridges that will allow value to frictionlessly traverse through different blockchain ecosystems (e.g. Cosmos).

We see the next two years as the time when these platforms will prove (or disprove) their viability and pave the way for immense value creation from 2021 onwards.

The evolution of the Bitcoin mining landscape

A short twitter thread on the evolution of the mining landscape in Bitcoin. In the short space of 10 years, we have gone from cypherpunks and GPU’s, to pre-IPO behemoths and ASICs. Will it be sovereigns next?

What you see below, is the distribution of miner rewards in $BTC terms, since the first block was mined.

— Elias Simos (@eliasimos) August 1, 2019

If you squint a little, you can discern 3 distinct developmental phases. Let's call them;

1) the hobbyist era

2) the exploration era

3) the professional era

A short thread pic.twitter.com/Hp5i80AIOe

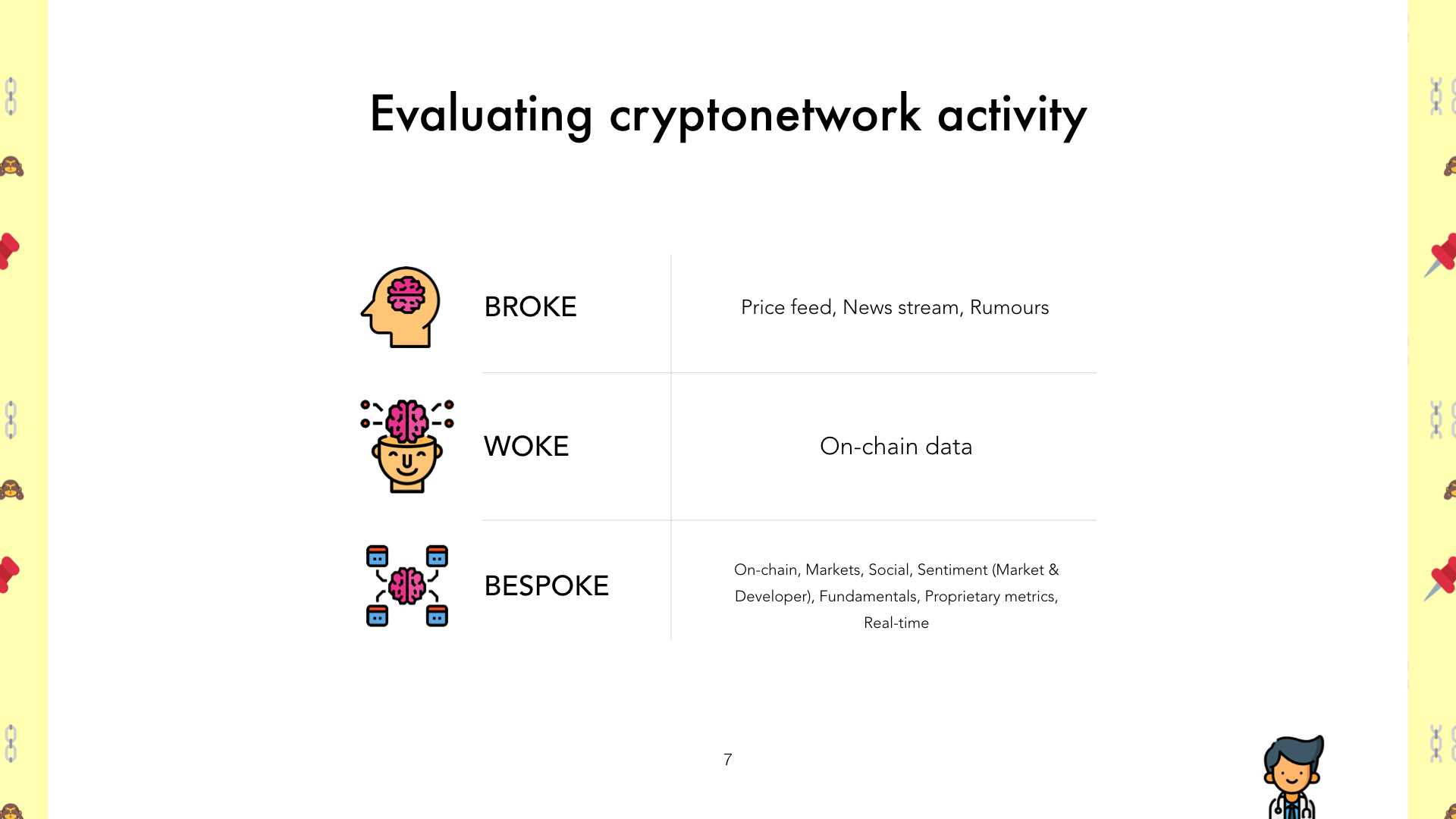

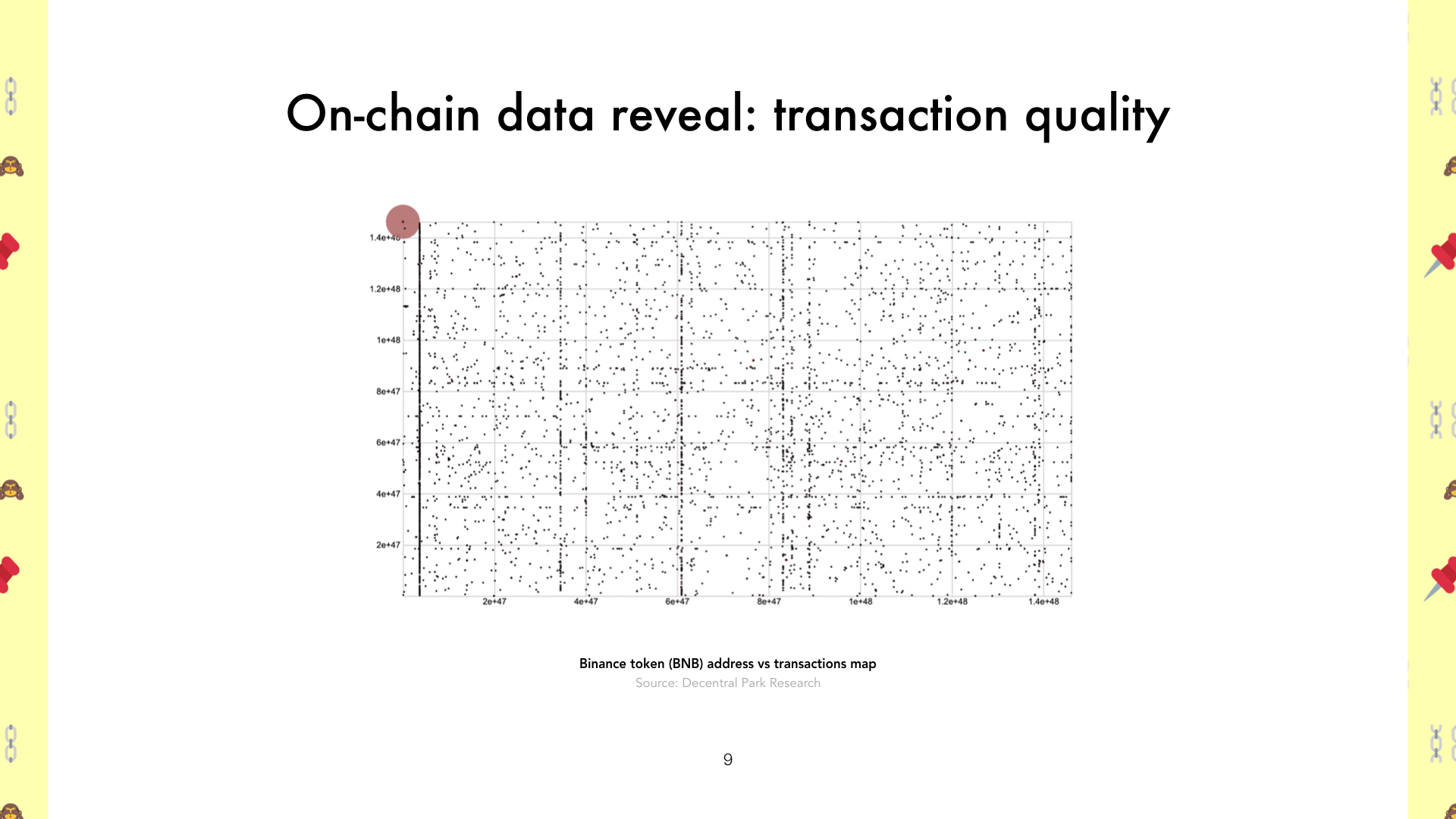

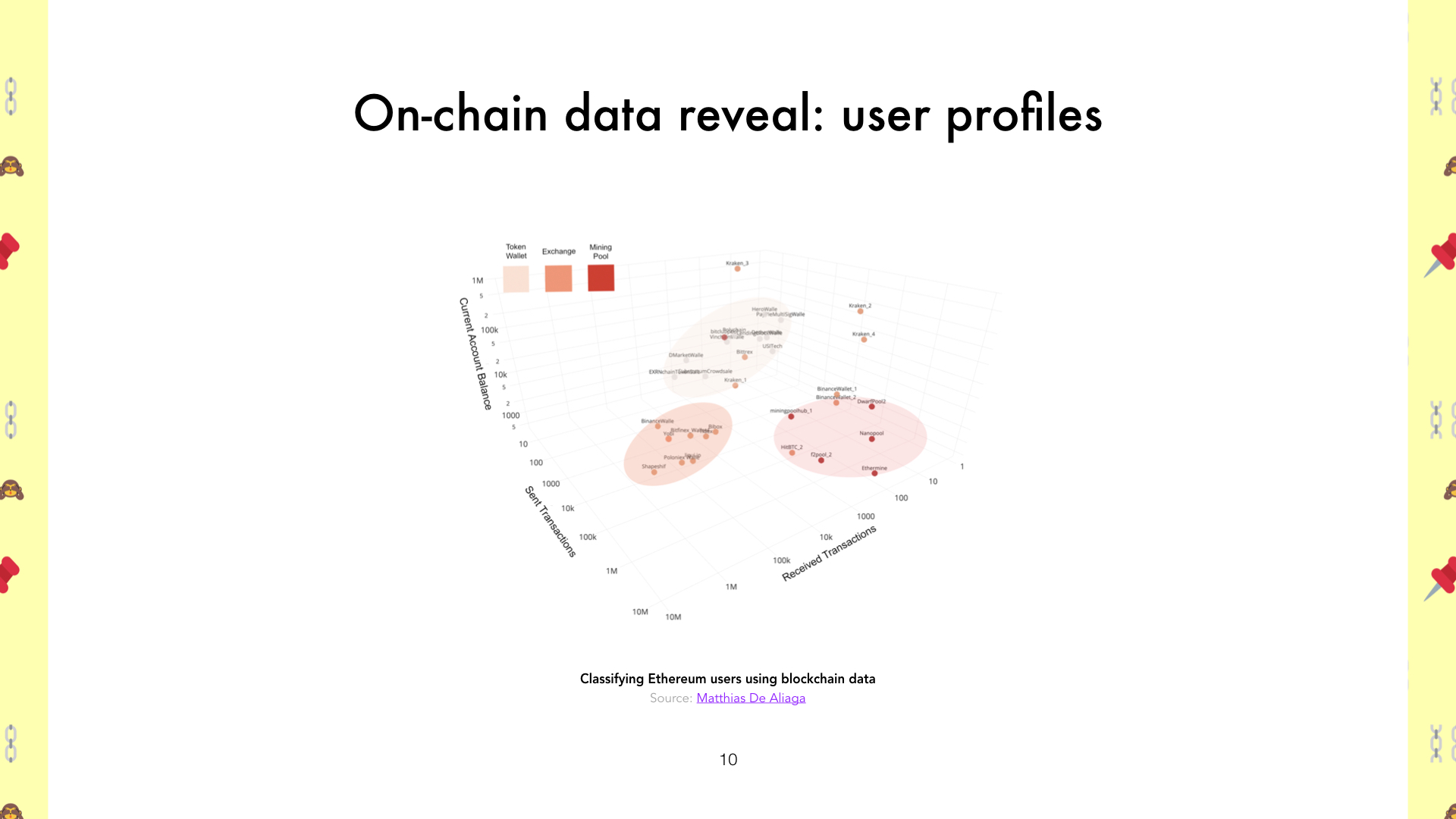

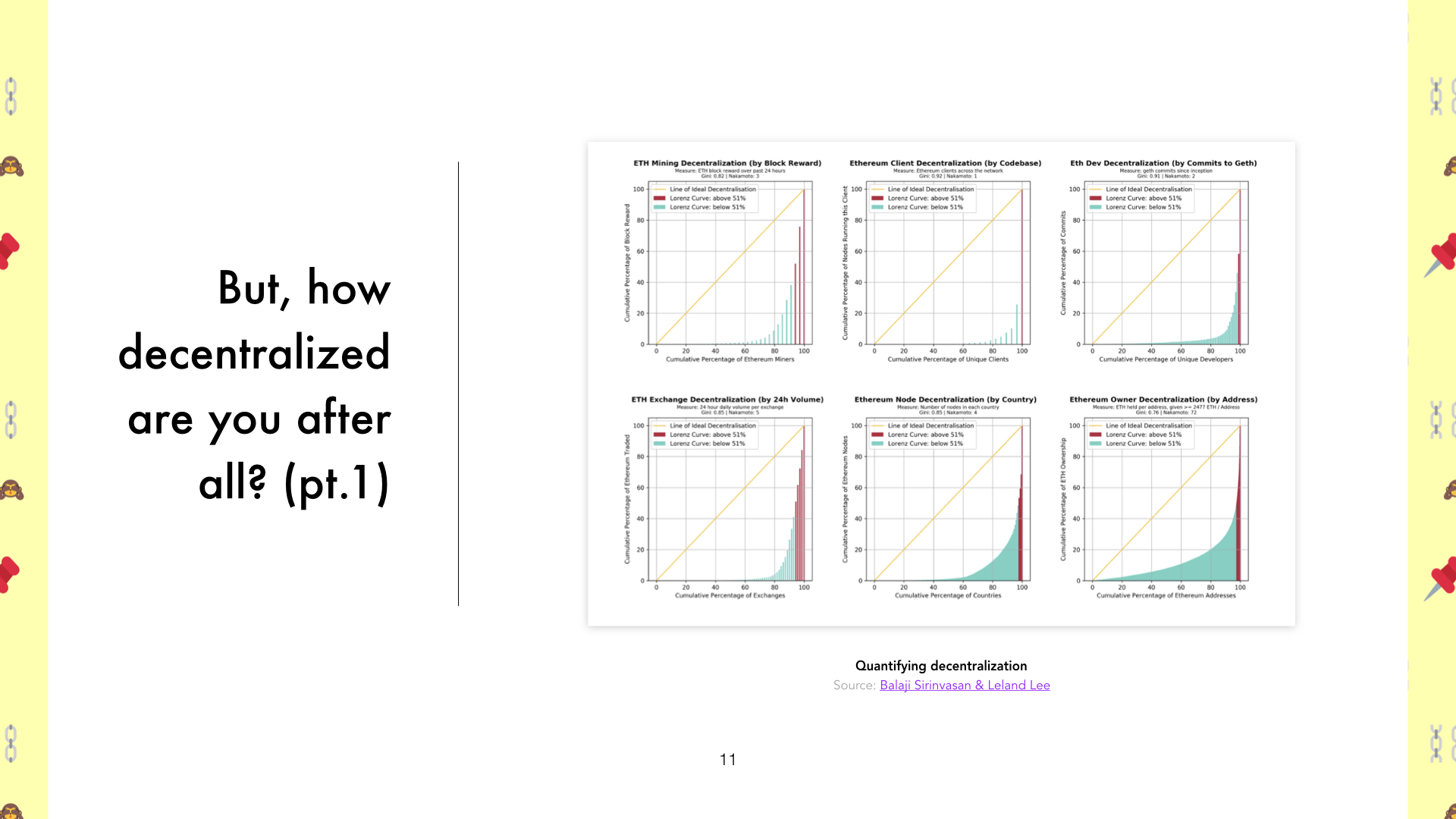

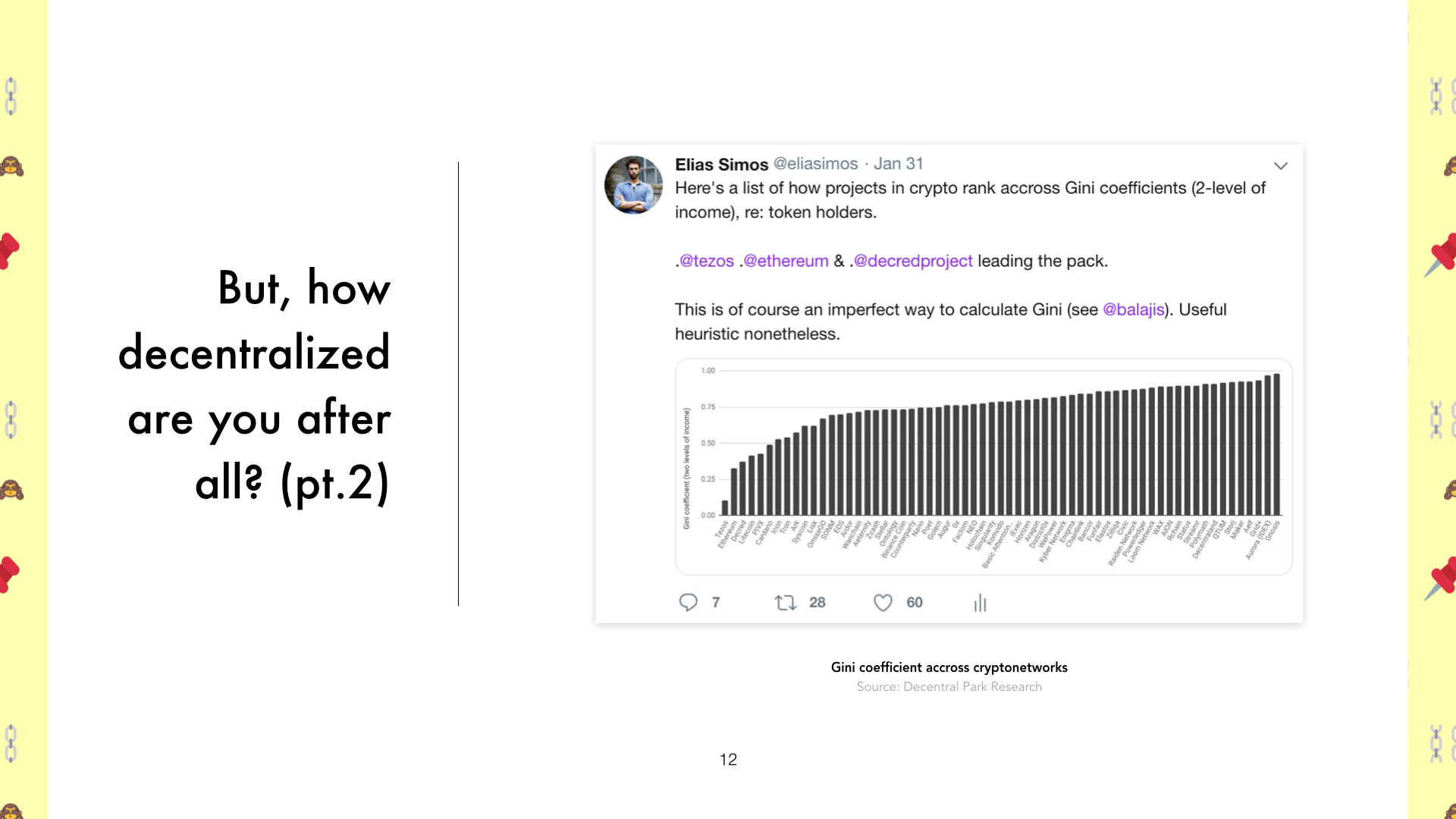

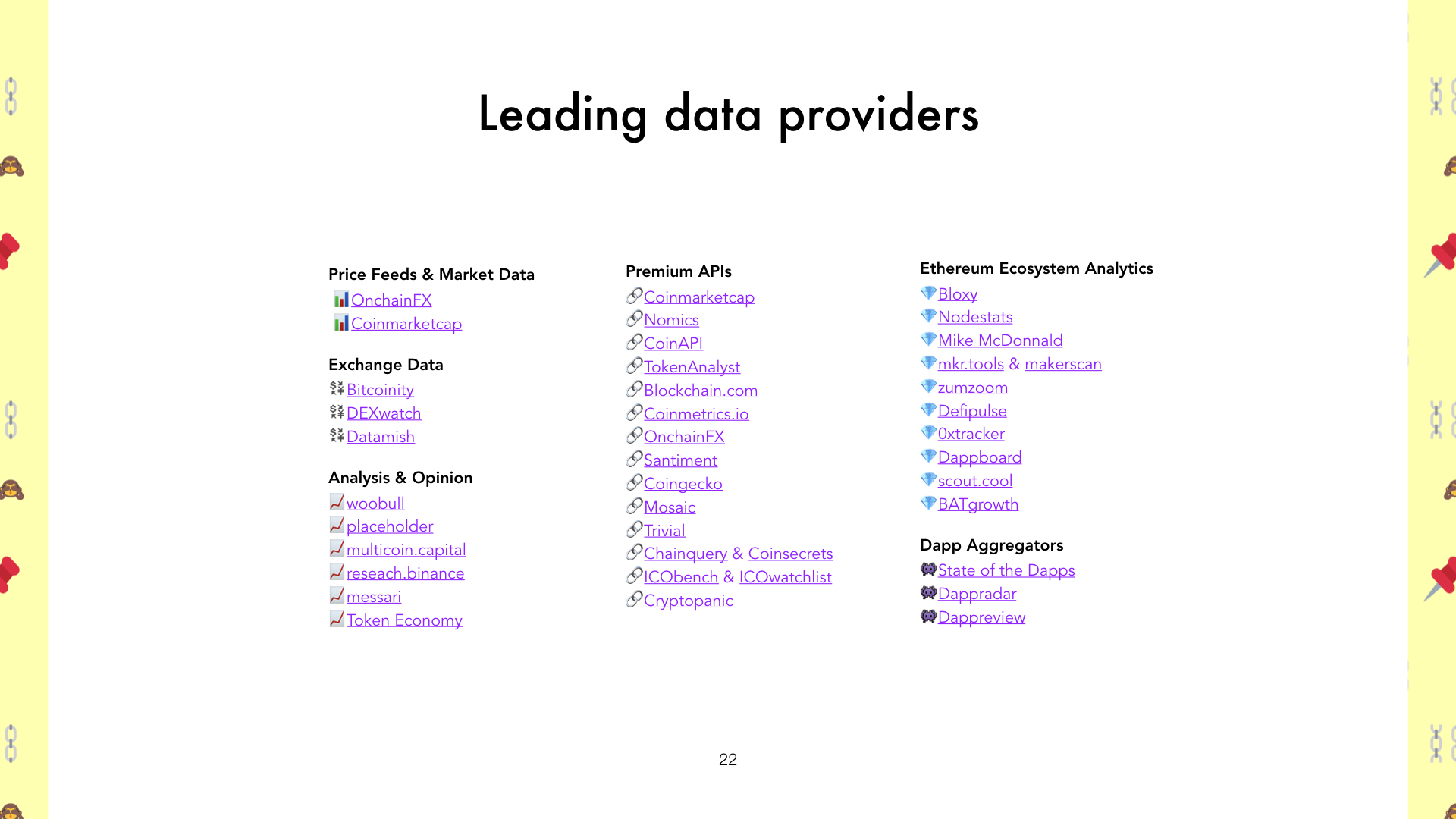

Using data to evaluate the health of cryptonetworks

Presentation for a talk I gave at the Data Natives meetup in London.

Can’t recommend them enough. If you’re into data and in and around Europe, it’s worth taking a look at their meet-ups and conferences.

A proprietary indicator of Bitcoin tops and bottoms

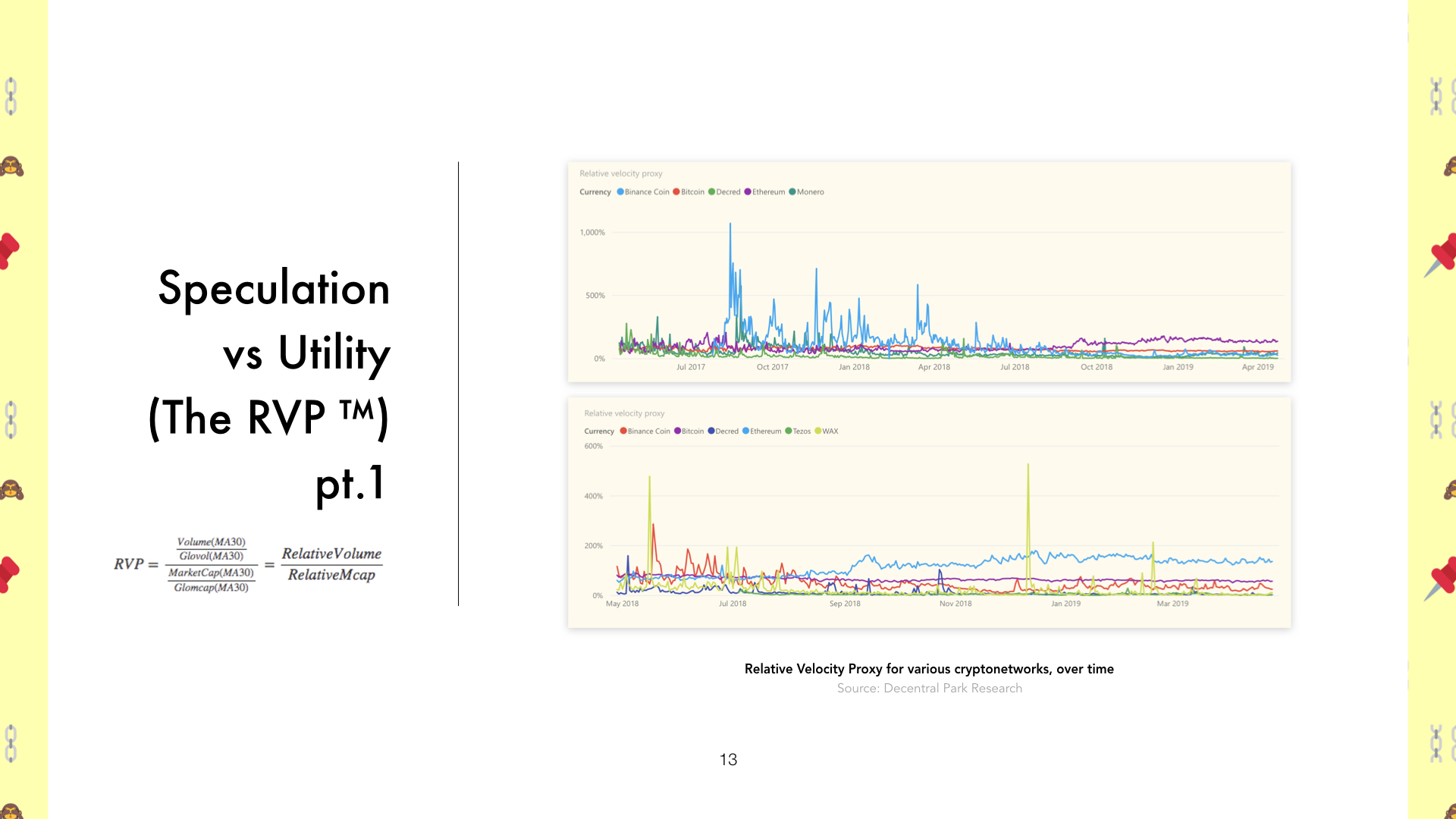

The avid readers among you, will remember that back in November 2018, I was playing around with a propretary indicator/ratio that looks a little bit like an inverted, relative NVT - which I called the RVP, shorthand for Relative Velocity Proxy. The RVP is a way to track how an asset's daily volume (adjusted for a 30 day average) compares to the global volume and then further adjusting for its relative market cap. Below you'll find how the metric is derived - where Glovol is the 30 day moving average of the global volumes in crypto, and equivalently Glomcap is the 30 day moving average of global market cap of cryptoassets.

So what this effectively shows, is how much exchange volume is being driven through a cryptoasset, weighted by its market cap, all relative to the total cryptoasset universe. The relativity in this case helps reduce the noise introduced by mis-reporting on volumes from exchanges, by making it the common denominator. My intuition behind experimenting with this metric, was that periods of outter bound relative velocity, should mark pivot points for an asset's price - these are the points in the 1% edges of the probability density function of the RVP.

The bottleneck back in November was that we didn't have enough data available to be able to run a longitudinal analysis and see how the ratio behaves over time. However, at present, our newly build market tracking dashboard and database can finally power that type of analysis - and pretty much for any asset in the book. In fact here's what it looks like.

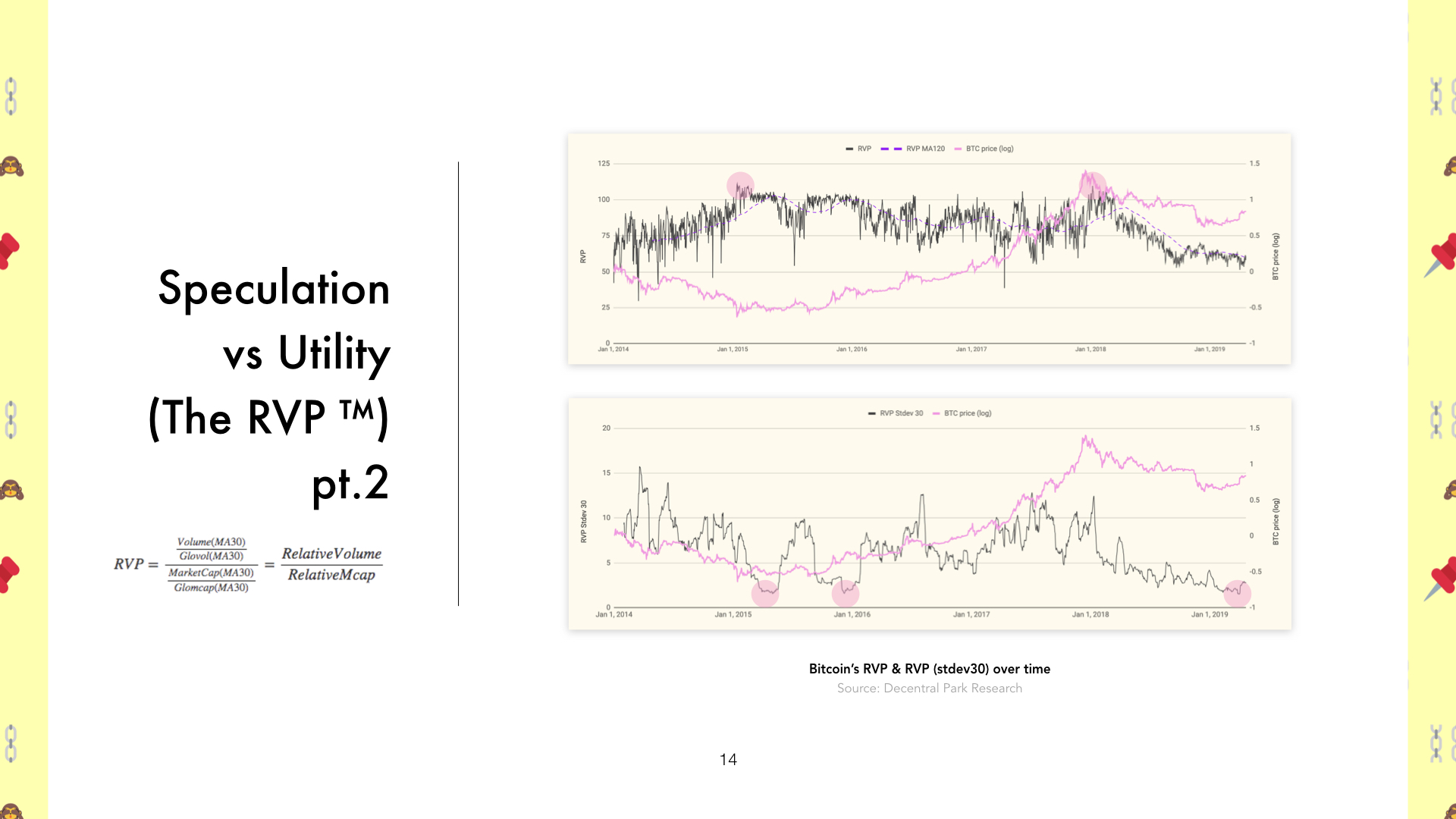

As I am still experimenting with the utility of this ratio, I decided to first focus on how it applies to Bitcoin; after all, the NVT - a sister ratio to the RVP - and its different variations, have been used widely in order to "value" Bitcoin. Below, you'll find a plot of the RVP and bitcoin's log returns since Jan 2014.

At first glance I found no obvious indication of signal, but it did feet like there was something hidden in the noise - and so I took a closer look at the edges of the distribution. This is what I found;

The coloured areas in the chart signify the respective market environment of the period - red (bear), yellow (accumulation), green (bull). What is really outstanding here is that the very top ends of the distribution in the RVP (RVP= ~120; black pointers in the chart), coincide perfectly with the perfect bottom of 2015 and the perfect top of 2018. How is it possible for the top of the distribution to point to opposite ends of the market cycle?

Considering the fundamental meaning of the RVP, the very top of the distribution points to conditions of extreme/outstanding volume or conditions of extreme capital flight (while the utility aka relative volume is constant) - aka blow-off tops and capitulation events.

So far so good, but the next observation here was the following: "if this thing is good at capturing capitulation events, then why did it not capture the capitulation event in Nov. 2018?" One reason we could potentially explain this, is that the November event was not a market-wide movement, but rather a concentrated action event that took place over a short amount of time.

Looking a little more closely, I found another commonality in the RVPs around the bottoming formations in Bitcoin's price - both are lie at the ends of the RVP probability density function (one at the top end, and one at the bottom end) AND both find the volatility of the RVP at a minimum. To illustrate, I have plotted the 30day standard deviation of the RVP against the log returns of Bitcoin below;

The last time the volatility of BTC exchange volume shares relative to the market share of Bitcoin was as low as it was in early April, was in April 2015 and December 2015 - ergo, very close to the beginning and the end points of the last Bitcoin accumulation phase!

Overall, some very positive indications here. This is still a work in progress and reservations should be held on the robustness and validity of the insights, but it is also likely that the early insights from the analysis of the RVP, may be an important step to solidifying one more valuable tool in the analyst's arsenal.