Your Custom Text Here

Beyond the hype on xDai

Aka, the DAI of DAI, the native Ethereum stablecoin for fast and cheap P2P transactions, and one of the more hyped projects to come out of the Ethereum developer ecosystem in 2019. By way of xDai recently raising a $500k round led by B-Tech - the investment arm of BitMax.io and Focus Labs - the project came to my attention recently and thought it would make for a good Daily exploration. So without further ado, I'll take some time to present you with the TL;DR on xDai, along with a few quick-fire thoughts on what's good and what's not about the project.

What is xDai?

xDAI is both an Ethereum sidechain, and a token that is pegged to the US Dollar via the DAI, has extremely low transaction fees, and very fast transaction times.

The project was brought to life in a collaboration between POA Network (one of the more active developer teams within Ethereum) and Maker DAO. Users can convert Dai to xDai via POA Network’s TokenBridge, which connects Ethereum and xDai chain.

How does xDai work?

The xDai blockchain is a wholly separate network from the Mainnet that achieves much higher throughput by scaling up the block size and scaling down the block producer (validator) count. The sidechain mechanism is powered by POA's Tokenbridge, and as such requires an own set of validators, separate to those active in Mainnet.

xDai works with 10 validators that are responsible for running nodes and setting the network parameters.

The way xDai is minted works as follows: you lock DAI in a contract on Mainnet, and the validators on the xDai chain mint DAI on the xDai chain to you. Effectively, xDai trades decentralization for performance.

Why xDai and not just DAI?

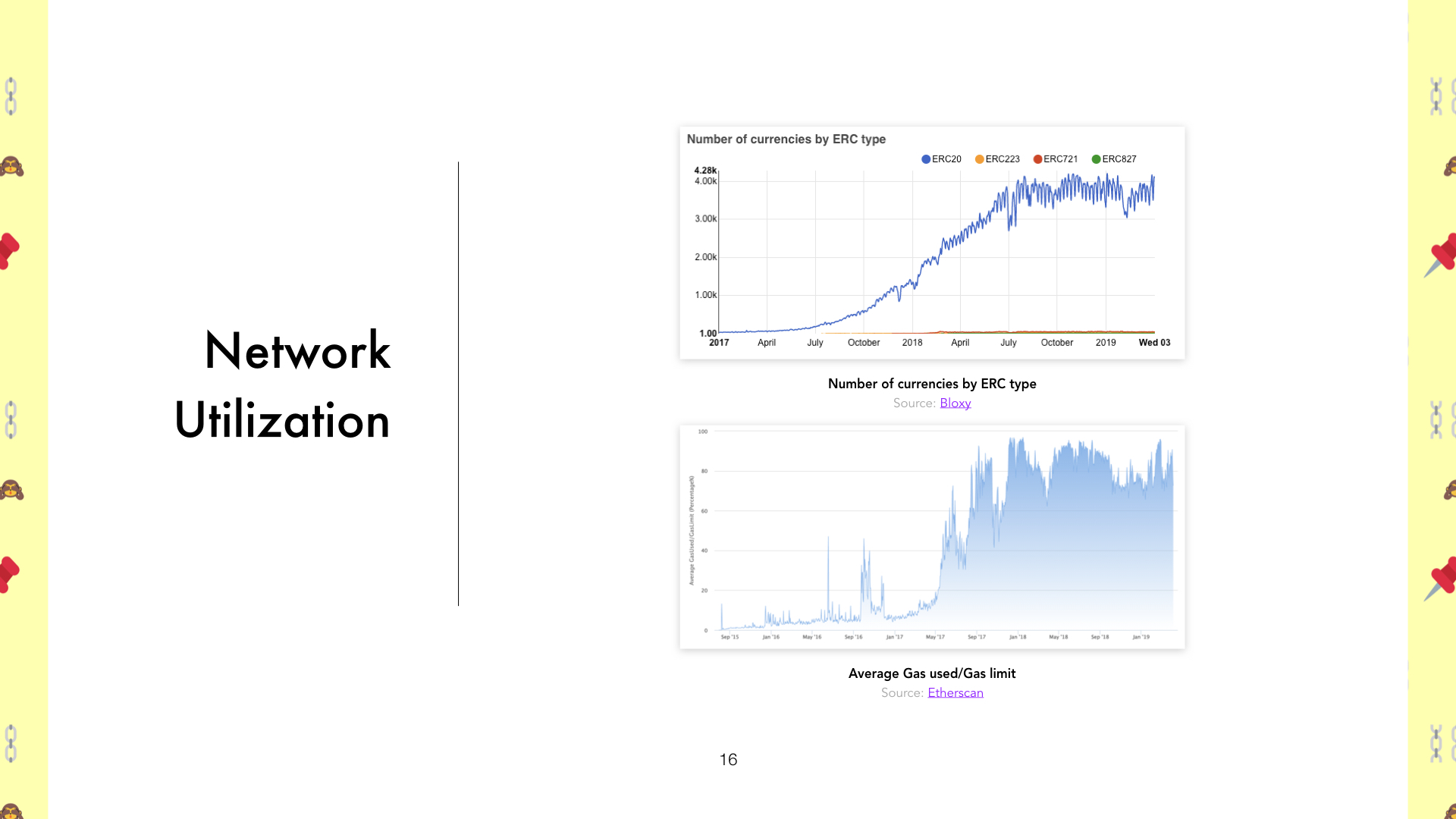

As a Mainnet token, the DAI is subject to the wild fluctuations that transaction costs on the Ethereum network undergo - tied to a large extent to the availability of resources on the network.

The chart below shows how the history of the median transaction fee on Ethereum, since Q3 2017. Indicatively the median tx fee for 2019 is close to $0.1.

Via the sidechain mechanism (and some sort of transaction batching/key-synching bridge with Mainnet) xDai manages to perform transactions at a steep discount to DAI on the Ethereum Mainnet. More specifically, the cost to perform a transaction on xDai, is about $0.000021.

As we explored above, more recently the same function in Ethereum costs 4000x more (or 0.25% of the transaction value on average), while in the normal financial world, with what it costs to send money in the normal the cost of money transfers is upwards 3% (for international transfers).

Similarly xDai records impressive performance in the transaction speed dimension too. Transactions on the xDAI blockchain occur within five (5) seconds, while a typical Ethereum transaction takes about 1–3 minutes and a normal financial world international transfer, way over 24 hours.

And what about early traction?

Established in October 2018, xDai Chain has attracted the attention of the ecosystem, thanks in no small part to Austin Griffith’s Burner Wallet, which provides a quick and easy way to carry and exchange small amounts of spending-crypto using a mobile browser and serves as a low-friction way to onboard new users.

xDai was used at ETHDenver (Feb 2019) as a platform for the Burner wallet, which allowed thousands of attendees to seamlessly buy food and transfer funds. 11 food trucks accepted xDai via Burner Wallets and sold 4,405 meals for a total of $38,432.56. And the total fees were only $0.20.

xDai was also used during ETH New York, though no similar figures have been made public. Beyond that, there is only one Dapp outside the wallet contingent that uses xDai - and that is the somewhat fringe prediction's market Helena.

Having reviewed what xDai is and how it works - brief as it might have been, let's now consider what xDai has going for it and where it falls short.

In favour of xDai...

- Ultra fast and cheap transactions with stable value. Could really be a game changer for Dapp adoption by providing a significant UX improvement.

- Can see it having significant impact in P2P payments (although one can argue that this is not really a problem in the developed world).

- Supported by two of the strongest developer groups in crypto (MakerDAO and POA).

Against xDai...

- Pegged to DAI, therefore pegged to USD, right? Wrong! The DAI is notorious for breaking its peg with the USD.

- If Ethereum eventually scales via Ethereum 2.0, then xDai is obsolete, as the DAI itself will enjoy similar transaction speed and cost.

- Clunky UX; like with many things in crypto, getting xDai as a user, is far from easy. A user journey would look like this: buy ETH on Coinbase (Pro) with USD, exchange ETH for DAI, transfer the DAI to the Dex Wallet mobile app (dl the app), and exchange DAI for xDAI. Far from ideal.

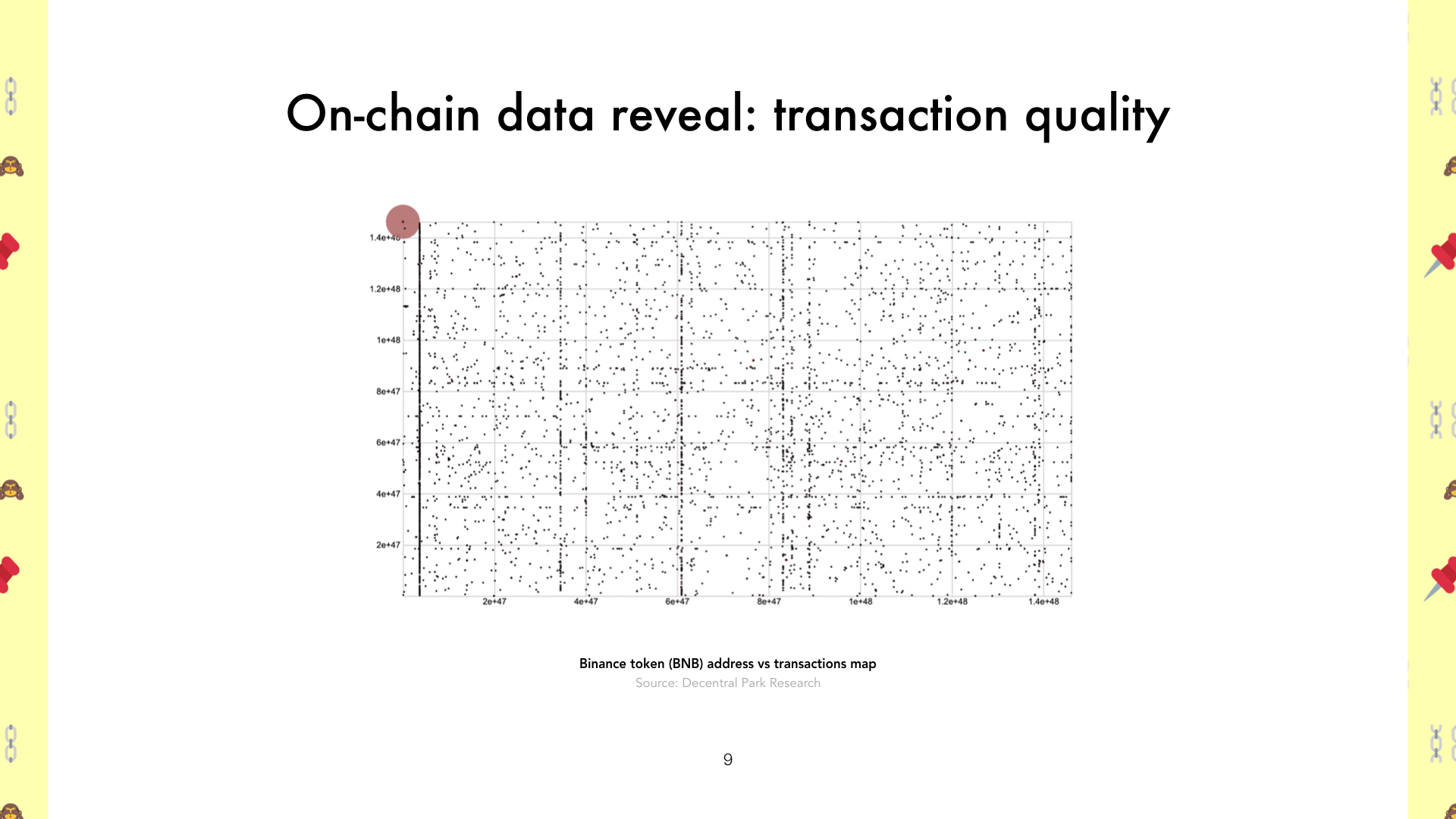

- Adoption story is over-sold; a quick glance at the types of transactions taking place on the xDAI chain, show virtually 0 P2P usage. Contract call type transactions are disproportionately high, while the most common USD amount transacted comes with 4 to 5 decimals.

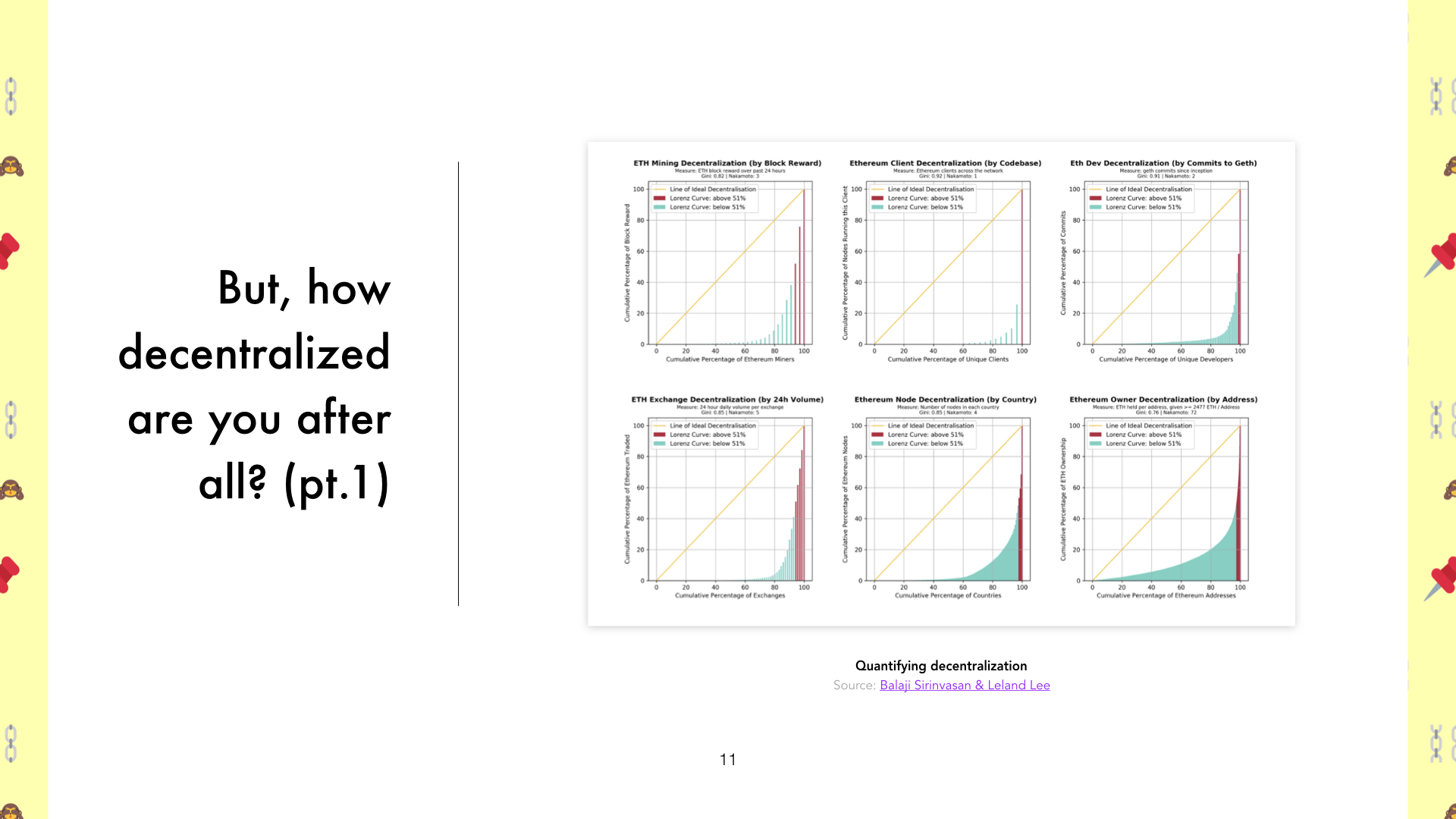

- Centralized; 10 validators control the parameters of the ecosystem. This might not matter much as long as xDai is inconsequential, but will certainly matter if/as things progress (e.g. see EOS).

For all its promise, xDai seems to lose out in a tit for tat and leaves the observer with much more to be desired...

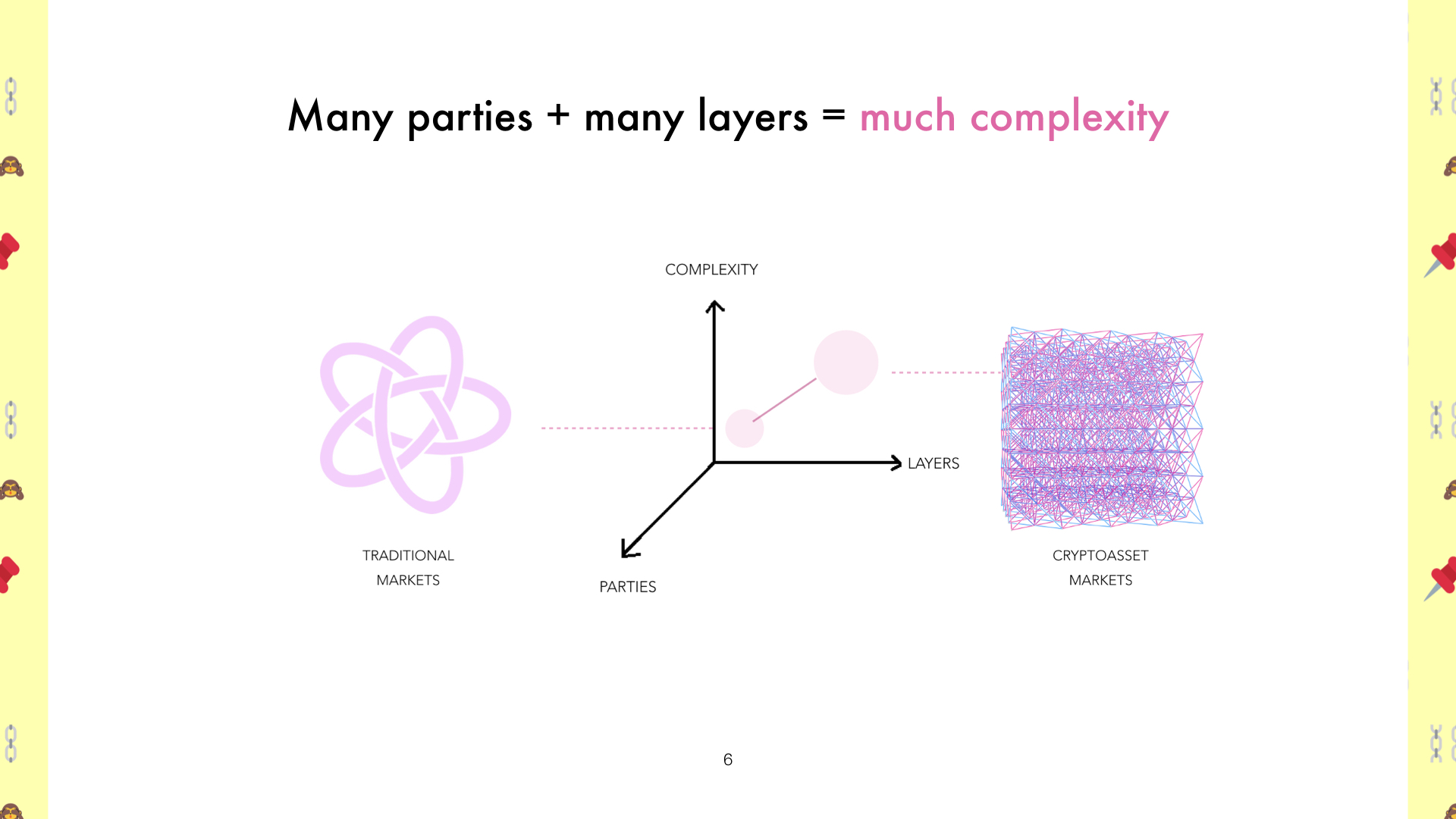

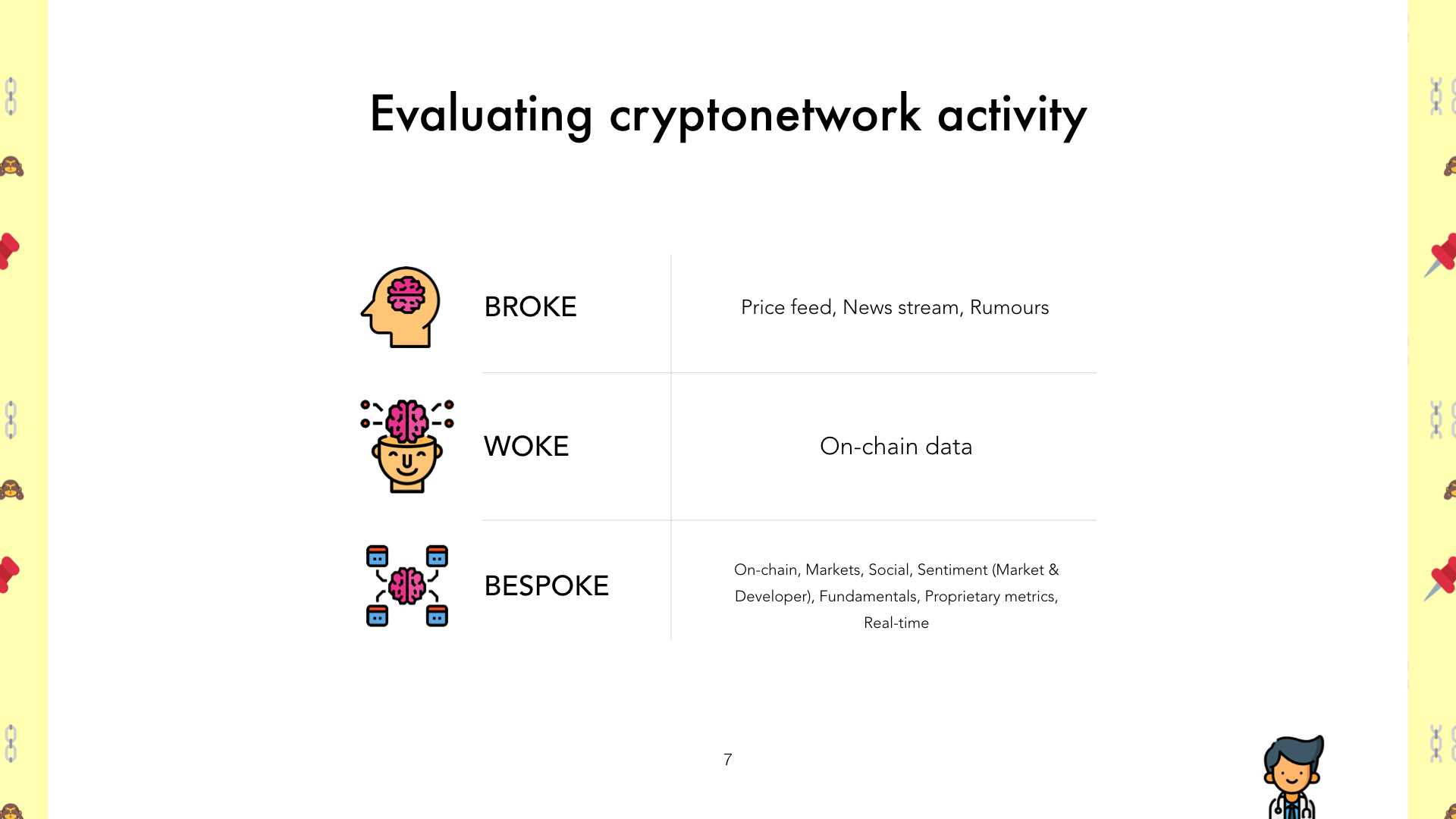

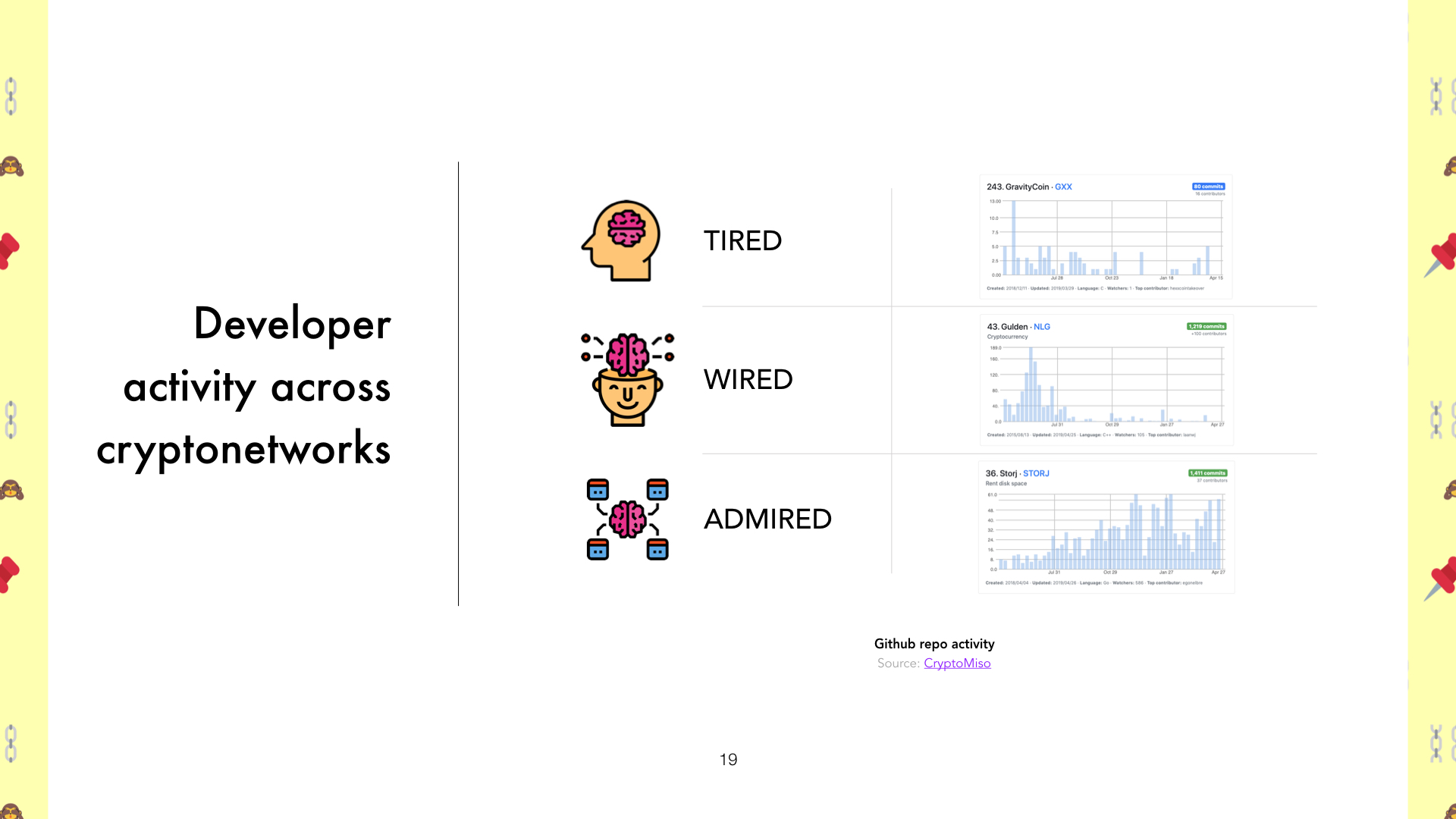

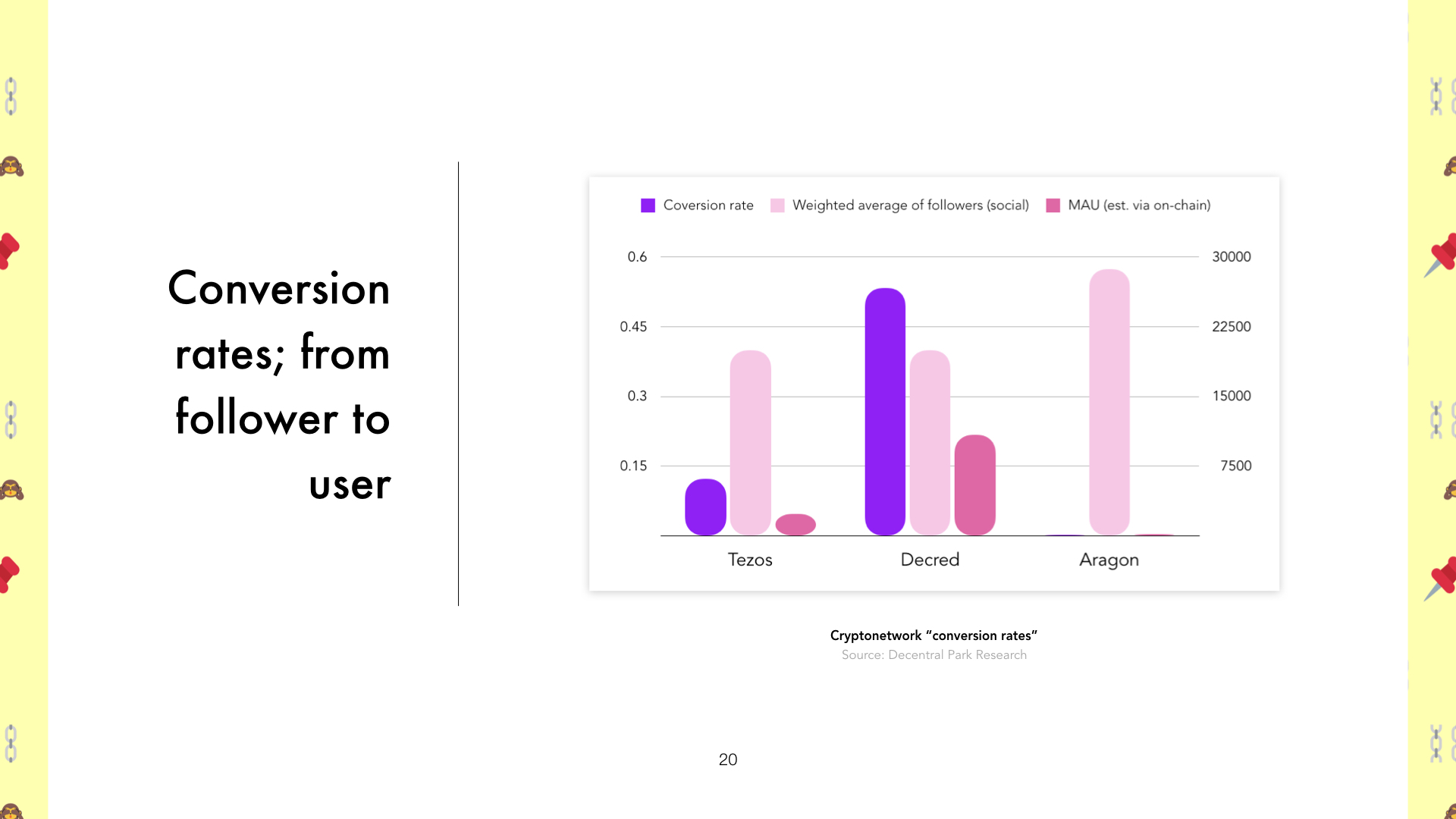

Using data to evaluate the health of cryptonetworks

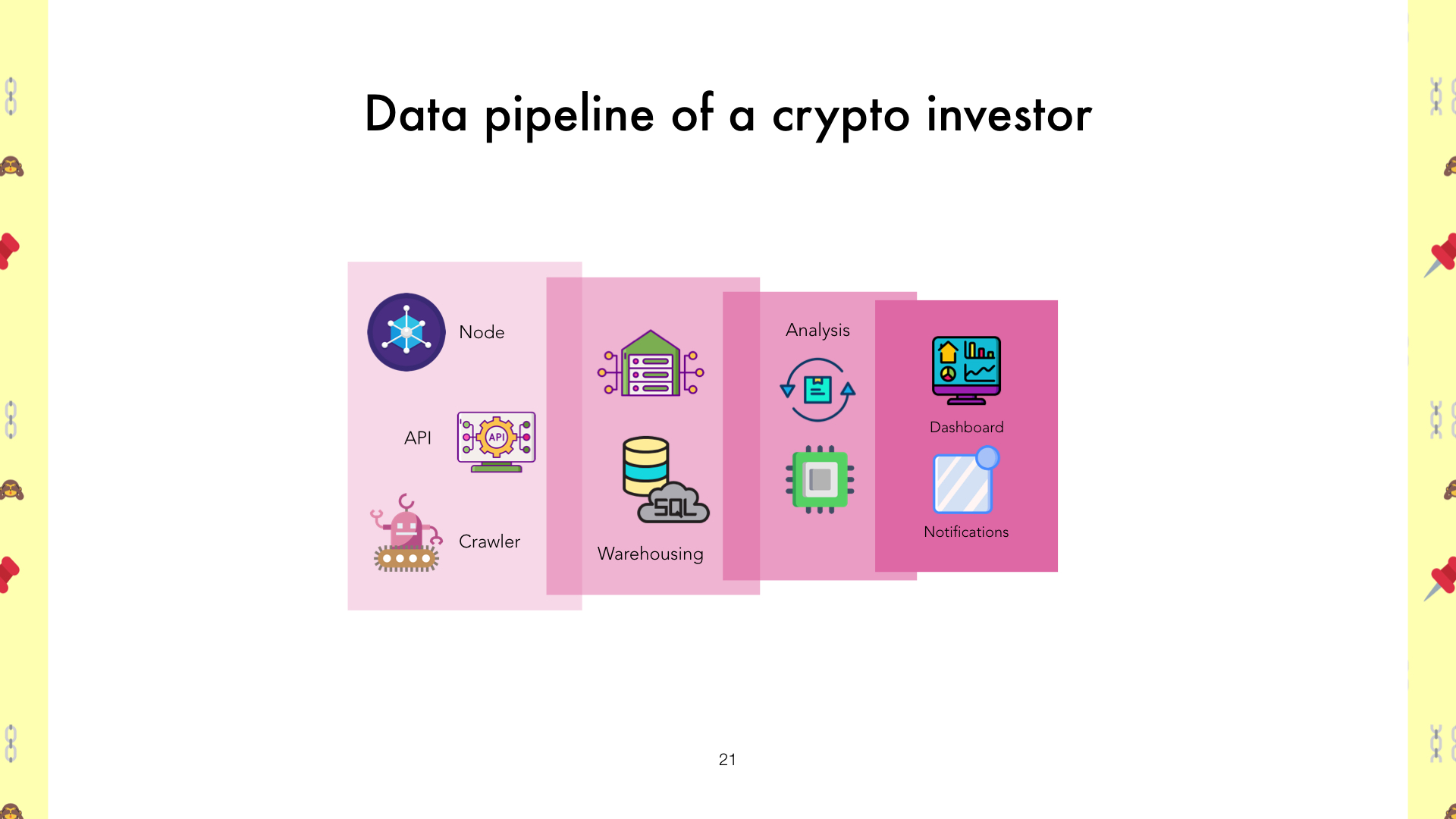

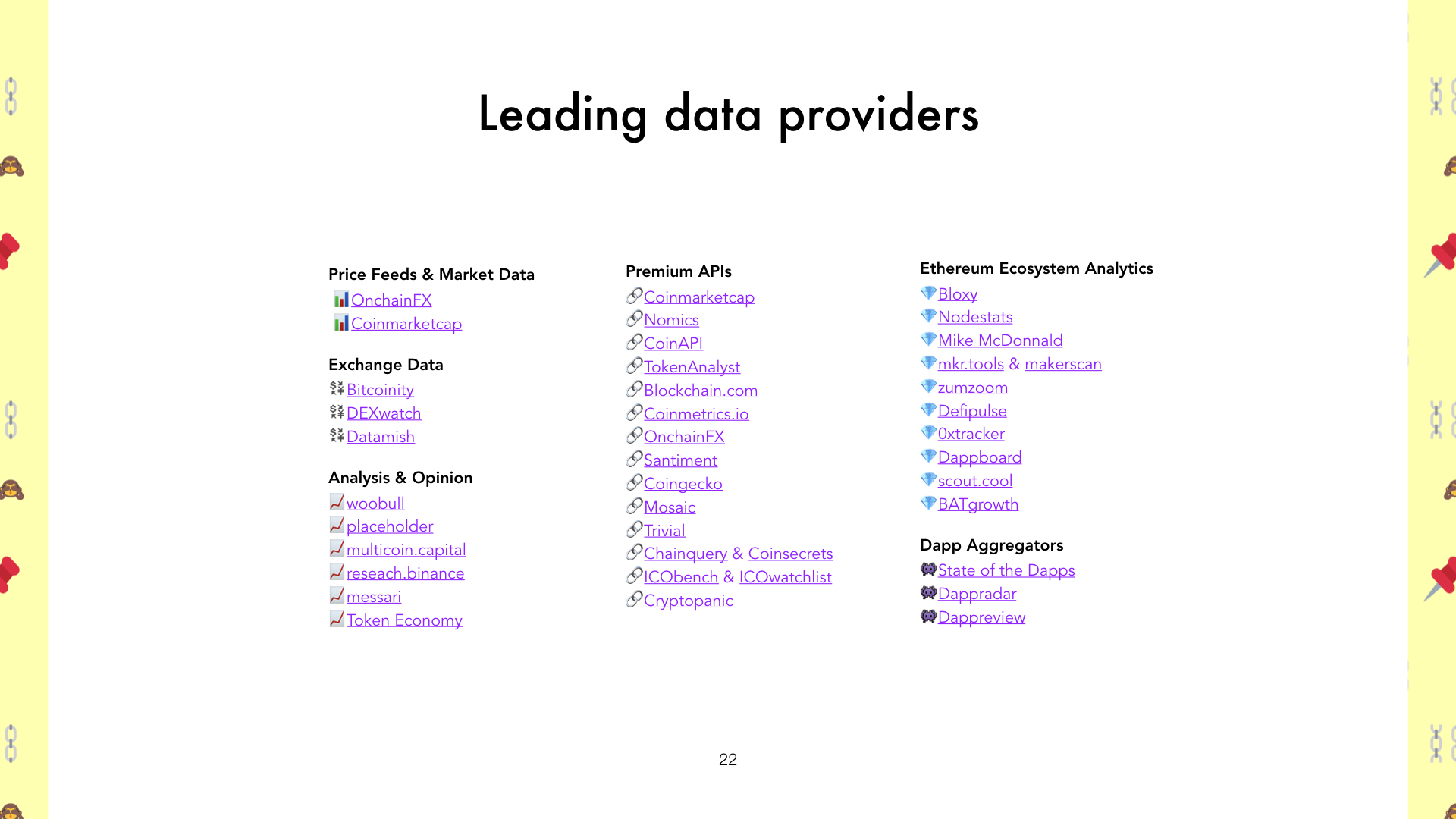

Presentation for a talk I gave at the Data Natives meetup in London.

Can’t recommend them enough. If you’re into data and in and around Europe, it’s worth taking a look at their meet-ups and conferences.

Beyond the hype on Uniswap

More recently, a lot of metaphorical twitter ink has been spilled over Uniswap, a DEX built on Ethereum, that has no underlying token and has been thus far built on the accord of Hayden Adams, with a couple of small grants from the Ethereum Foundation and balance.io.

It's pretty easy to understand why all this hype around the DEX, as since its launch in November, Uniswap has been recording some impressive growth numbers. Today we'll try to uncover if there is more to the application, than bored ETH whales moving money around, playing with the newest community toy.

Uniswap is an on-chain market maker allowing the swapping of ERC20 tokens, as well as ETH to an ERC20, and vice-versa. It also allows participants to contribute to liquidity pools for any ERC20 token, and gain commissions in the form of exchange fees for doing so. The model looks a lot like the Bancor network, with the main differences being that (i) Uniswap charges no listing fee - Bancor requires staking BNT tokens to create a market, (ii) costs significantly less gas, and (iii) is entirely decentralized and therefore censorship resistant - whereas on Bancor, markets can be frozen.

The removal of all those friction points in the model - compared to Bancor, has lead to Uniswap quickly attracting a non-trivial amount of ETH & DAI liquidity (plot #1 below), while it is increasingly attracting a larger share of the total trades executed on DEXes (plot #2 below).

Uniswap uses thin delegateproxy contracts (similar to eip-1167, but using a different bytecode) for creating new markets, so it's extremely cheap. Market pairs also only exist from ETH-token, which means a token-token pair doesn't need its own market, it just needs the 2 tokens to have an ETH pair.

Another interesting element of the model, is the fact that there is no order book. Instead the trades get settled at an exchange rate provided by a simple equation - x * y = k . k is a constant value that never changes, whereas x and y represent the quantity of ETH and ERC20 tokens available in a particular exchange that ultimately determines the exchange rate. The curve below represents the possible exchange rate outcomes, at a high level.

I'll avoid getting into too much detail about how that works (refer here for more context), but a good takeaway here is that the simplicity of the model, provides a compelling way for *smaller* trades to get executed without any of the order book woes (e.g. liquidity gaps). This post from Ross Bulat on Medium describes the nuances of the model well - including the liquidity pool requirements and the key role of arbitrageurs in keeping the pool balanced.

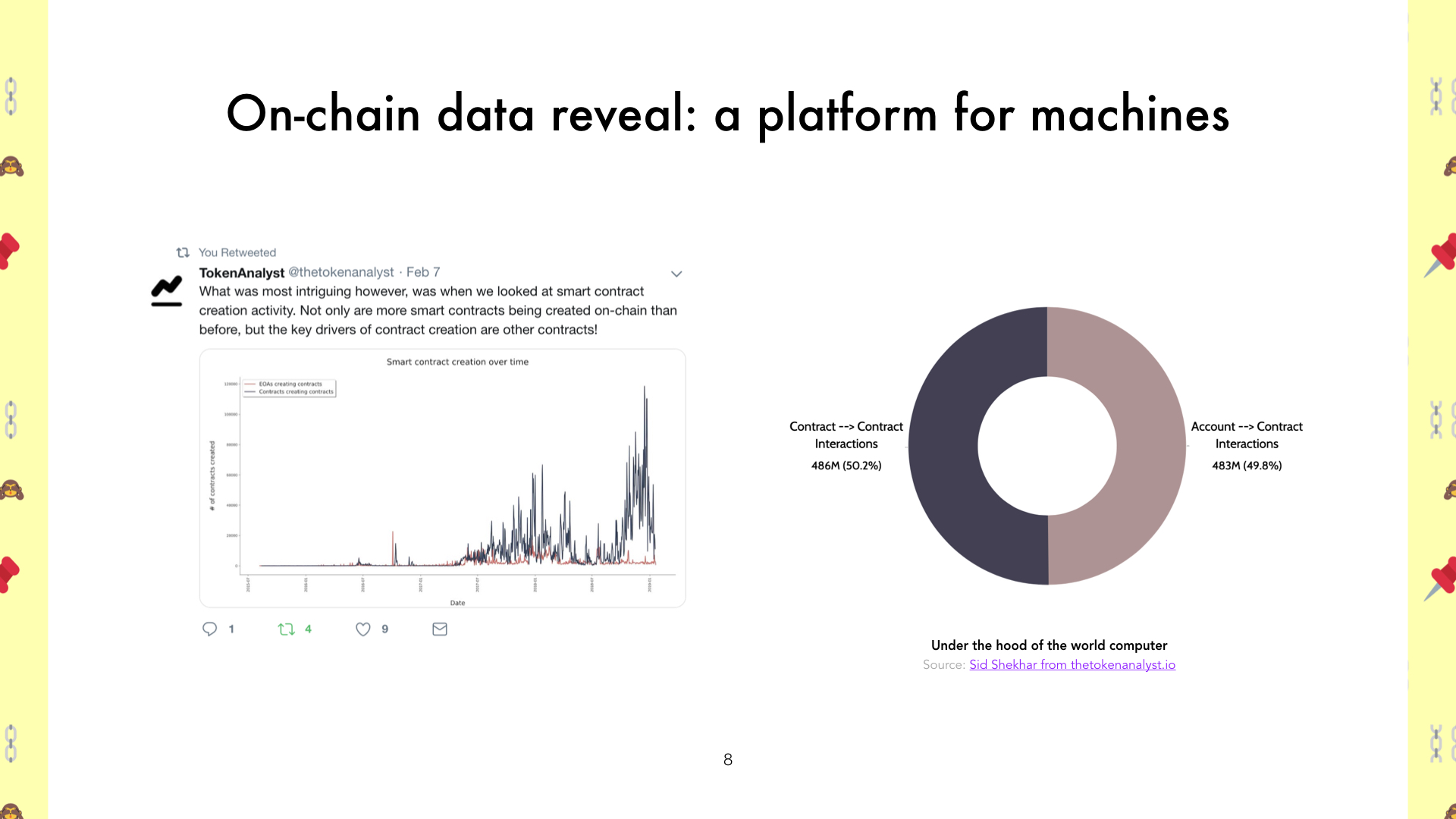

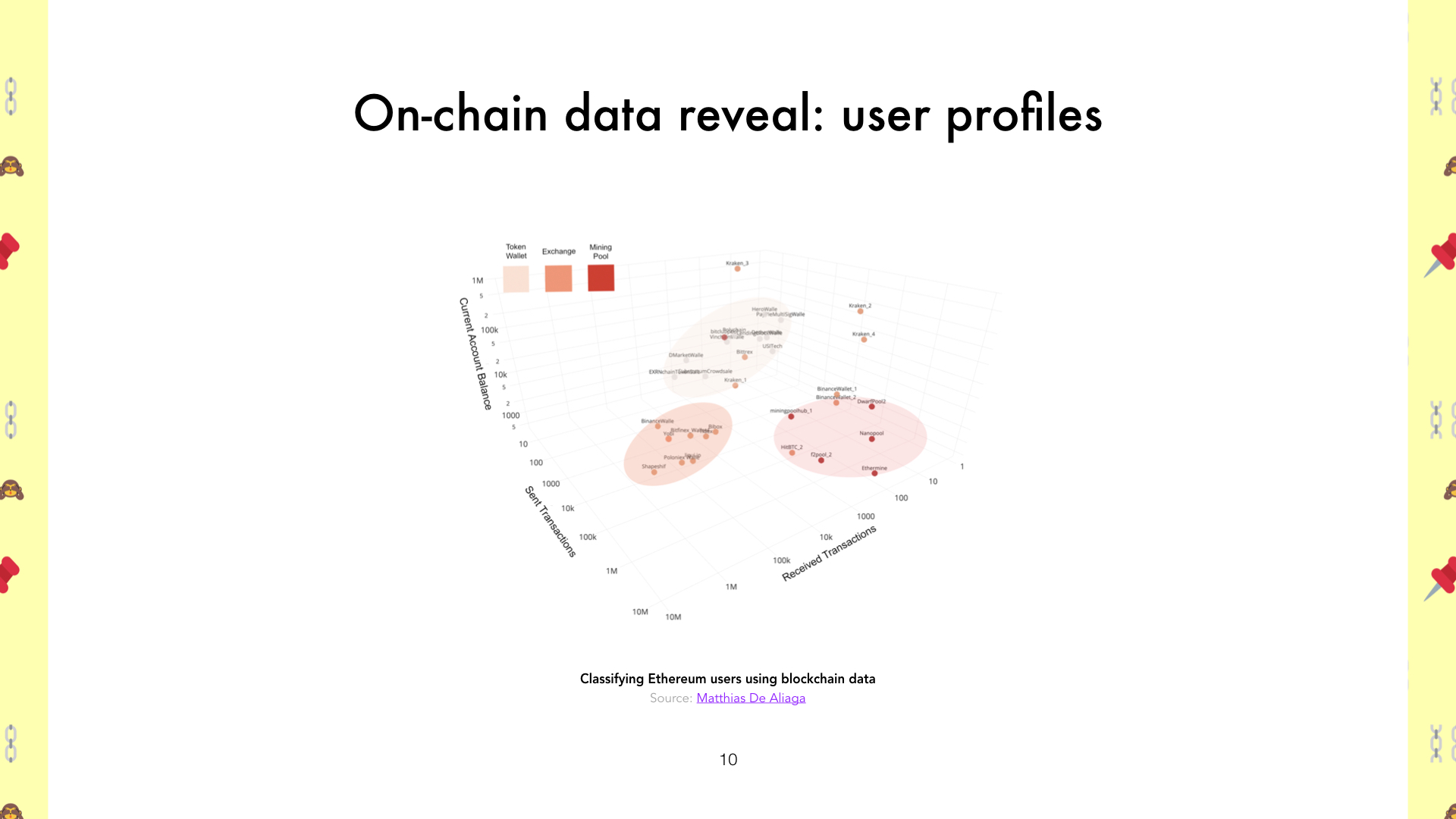

Now, you might wonder why that's useful at all?! Well, in fact, as Token Analyst uncovered in a recent post, *small* machine to machine transactions (or contract to contract) actually outweight human to machine transactions on the Ethereum blockchain!

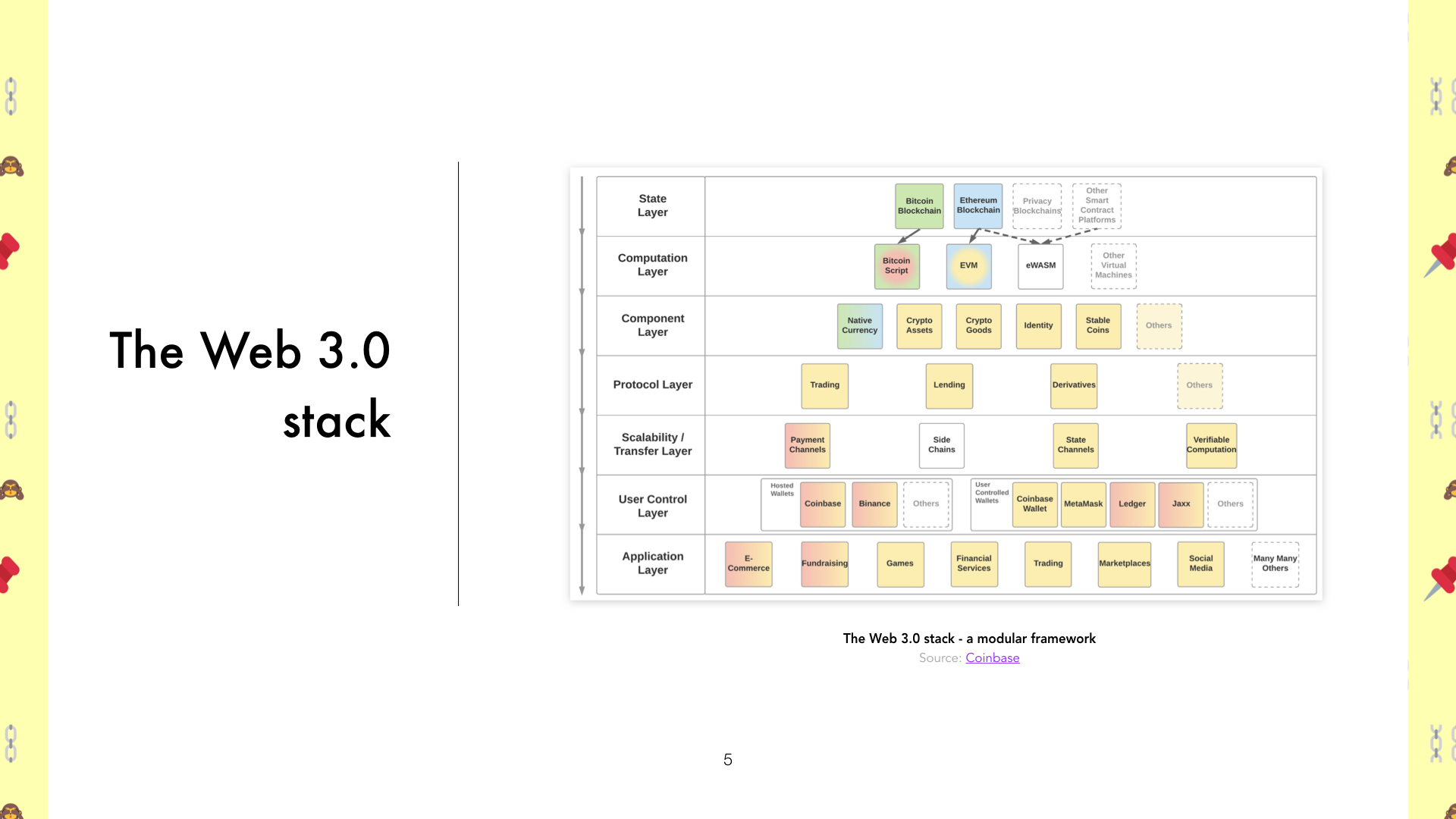

Moving forward, as scalability comes to the Web 3.0 stack and along with it meaningful Dapps, we can easily imagine the proportion swinging heavily towards the machine to machine side of the pendulum, with nexuses of smart contracts interacting with one another and millions of micro-transactions taking place daily. In that instance, DEX protocols like Uniswap are likely to unlock their full potential, allowing Dapps to access instant pooled liquidity, without the risk of slippage.

Of course the slippage story is different for larger transactions via Uniswap. According to Ameen Soleimani of Spankchain, with $50K of tokens in reserve for trading, it takes $350 to cause 1% slippage, $2600 for 5%, and $5500 for 10%. Thus the model is inherently limited by the static pricing mechanism, and its utility is limited to smaller transactions. That said, it's not hard to imagine a future where you have a range of different DEX protocols, for varying transaction sizes, and pooled liquidity.

Liquidity of course, will not come for novelty, but rather for profit. As it stands, the liquidity providers on Uniswap are entitled to a 0.3% fee off every swap, on a pro rata basis. This is not the only way one can make a return on liquidity provision. The liquidity provider receives tradable liquidity tokens as a unit of account of what has been committed to Uniswap. These tokens can be subsequently provided as collateral to Maker DAO (or another DeFi application or protocol that has a market for those) in exchange for DAI, which can then be swapped for a PoS token (e.g. ETH 2.0), on which the liquidity provider can earn further revenue. Here's how Uniswap envisions the model.

Pretty neat, huh? Be that as it may, there is a big caveat here and that is that said returns are expressed in ETH terms (or in terms of any other ERC-20 that is offered for liquidity). As such, any price change in the underlying asset (e.g ETH), would cause a reduction in the value of the stake, relative to holding the original assets, in a way that the resulting losses could be greater than the fees received. Effectively, there is no reason for a liquidity provider to participate, except for if they are long ETH. Pintail has demonstrated this very effectively in his study of the net position of account 0xf369af914dBed0aD7afdDdEbc631Ee0FDA1b4891, the very first liquidity provider to the Uniswap smart contract.

Given ETH's price swings, the net position of the liquidity provider has been negative for most of the time since engaging in the contract. At the same time, however, the user has been collecting fees, which implies that were the price of ETH to return to the same level it stood at when the contract was initiated, the user would have collected close to 12% annualised return. The same author, explores how providing liquidity to Uniswap compares to HOLDing ETH for different levels of ETH appreciation.

Interesting; it appears that providing liquidity for Uniswap is more profitable than HODLing for between 100% and 150% appreciation range in the price of ETH, but less profitable beyond that range. For more info on how that result was reached you can refer to the equivalent post here.

There are a few more caveats to consider when assessing Uniswap's value proposition. First, each trading pair requires its own smart contract, so creating new trading pairs and markets could be quite costly and storage intensive. Yes, it only takes an ETH pair to create a new pair out of two ERC-20's (if ETH/ZRX and ETH/DAI exist on the platform, then ZRX/DAI is also possible), but still in considering the whole universe of ERC-20s (>3000), that is a lot of redundant smart contracts to store on a blockchain, that at present, has serious scalability issues.

Another thing to consider is that Uniswap is built entirely on-chain, which means it is more prone to front-running, and thus makes it expensive for market makers who may need to rapidly change strategies. It also means that speed is not part of the value proposition. Finally, Uniswap is provisioned for ERC-20 tokens alone, and has no apparent plans to support ERC-721 or other standards - which of course could change fairly quickly - but as it stands, limits its utility somewhat (thought truth be told, there's Boxswap for 721's, that does a pretty good job at covering that base).

In all, overlooking its limitations, it becomes fairly evident why Uniswap has managed to attract so much interest recently and with it, a fair amount of traction; an interesting model, with a simple UI/UX (see below), that managed to get off the ground with nothing but talent and a couple of grants. No ICO, no venture investment, no native token, no fanfare and big promises. In absence of all this baggage, it has managed to get adoption on the fly and put a compelling use case to front and centre of the small, but dynamic DeFi universe. But above all, it has driven home what is a valuable lesson that many have chosen to forget; underpromise & overdeliver.

The king is naked

The Diar has recently published some data on the treasury balances of ~100 crypto projects' ICO wallets, and I thought it would be interesting to run a few analyses on the data and see what sort of insights (if any) we can elicit. Before we dive in, it's useful to note that the projects examined here only represent 5-10% of the whole. There is a multitude of other projects that are not included in this dataset - or any other publicly available dataset as far as I know. If you happen to know of a more comprehensive resource, do get in touch. Now without further ado, let's get to it;

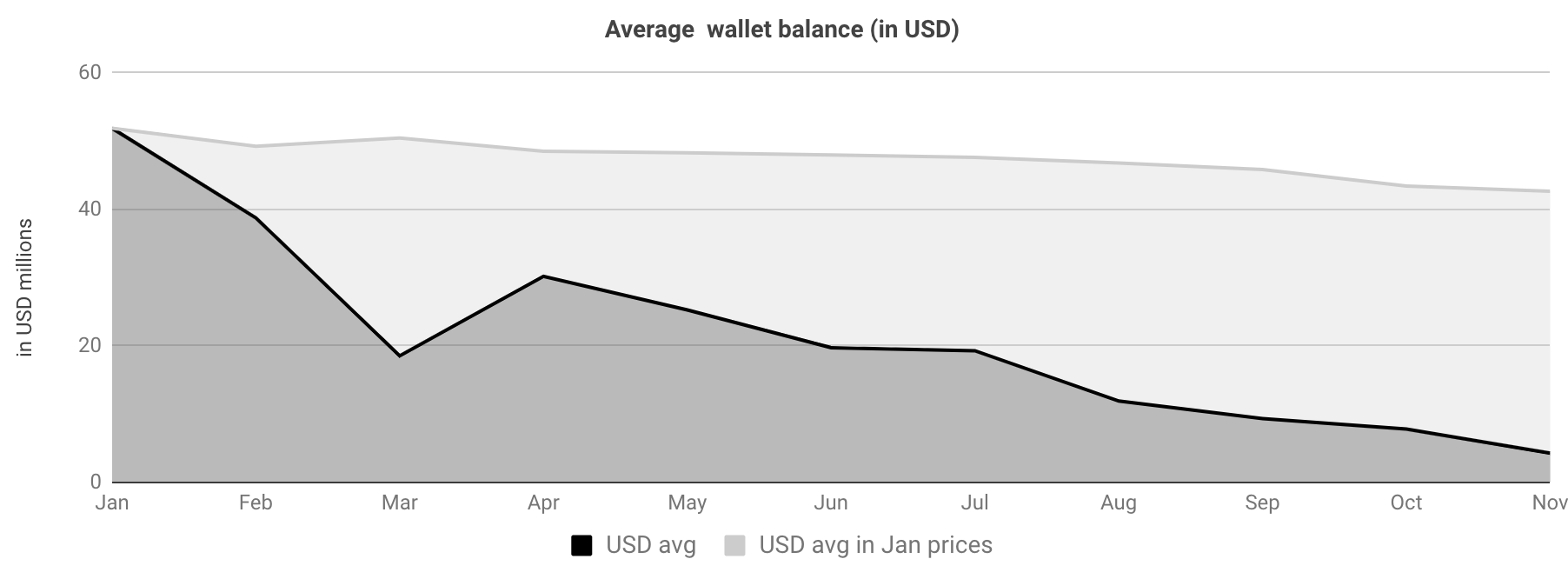

The first figure shows the total ETH balances in the projects' wallets and how that figure has been shaped over the course of the year. The total wallet balance has decreased by 17.8%, while ETH's price has decreased by ~90% from January 2018. Putting two and two together, this amounts to a 92% decrease in the USD value of those holdings. In absolute terms, the average project's treasury, lost about $38M in potential value held, since January - see figure below.

Theis is a summary of the simple average size of a random project's treasury, accross 2018, expressed in USD terms. The dark area represents the actual value of the treasury, while the light shaded area, represents the value lost due to ETH's price depreciation. In order to highlight the degree of potential mismanagement, let's run a quick thought experiment; starting out in January 2018, project ABC has $55M in its treasury. Let's also assume that the optimal budget distribution for ABC, looks something like what's presented below.

The above implies that ABC can hire approximately 60 professionals (engineers, ops, marketing), at Silicon Valley salaries (~$180k a year average), and keep them employed for 3 years. While I don't have concrete numbers on this, last time I checked, most projects that raised in 2017 are not on a hiring spree of that magnitude. Let's further assume that ABC actually consumed 17.8% of the $55M they raised (approx. $10M), out of which $5M is committed towards payroll (by the above assumptions). With that they hired 9 people, which sounds about right. Now, had they managed their finances optimally, they would still have enough money to hire another 50 people to help them build and ship. What the reality points to is that they can actually hire about 3 more people at SV salaries and keep them employed for 3 years. That's a tentative loss of 47 high quality professionals. Wow! Surely there was no CFO among those 9 hires that ABC went ahead with in 2018...Note that we are talking about are technology organizations that have raised money to deliver a product/network - not finance shops. As such I don't see how they can justify being long ETH.

Now let's have a quick look at how the total ETH liquidation activity relates to the price of ETH.

The correlations here are not very revealing; there is a positive 30% correlation (relatively weak) between this month's ETH liquidation and next month's %D in the price of ETH and a negative 40% correlation between this month's ETH liquidation and this month's %D in the price of ETH . In other words, there is some correlation between projects selling ETH and the price of ETH dropping, but it seems to not be the most compelling reason why. Again, we are only tracking ~5% of all projects here, so there is a chance that the correlations would increase if we had a more complete picture.

To round off the analysis, let's take a look at how specific projects have managed their treasuries thus far.

The dark area signifies how much the project's treasury was worth in USD terms in January, while the the light area represents the % of the treasury that the project consumed (or liquidated to USD). There are a few key observations here; (i) the distribution between total value in January and amount consumed is random, (ii) the amount consumed has not impacted price overall (for most projects) - one would assume that better management would translate to the market pricing that in and (iii) some of the most hyped projects, like Tezos and Golem, have consumed none of their ETH holdings in 2018.

There are a few conclusions that really stand out here; (i) the average project has no idea how to or low interest in managing their treasury and part of that lack of activity is most likely owing to the fact that (ii) in 2017 projects raised way too much money, compared to what they needed to ship product. It would also appear that (iii) many of the teams succumbed to the whims of an anchoring bias, and while the USD value of their ETH holdings 2-5xed over the course of 2017, they didn't bother to liquidate some, as that was way over the amount that they initially asked for. Of course, this is something that we already knew, but interesting to see how it has played out over time. This abundance of (notional) capital, surely did not create an optimal incentive structure for the teams.

As the industry matures, the need for diverse skillsets is evident, as is the current lack of design and ops/finance people in crypto - despite the increasing flow. While there are many things wrong with the "real world" that crypto has the potential to improve, there are equally many things done right, that crypto would be better off adopting.